Lessons From Capital Market History

Chapter 12

Created by David Moore, PhD

Topics

- Historical returns

- First Lesson: Average Returns

- Risk Premium

- Second Lesson: Variability of Returns

- Arithmetic vs Geometric Returns

- Capital Market Efficiency

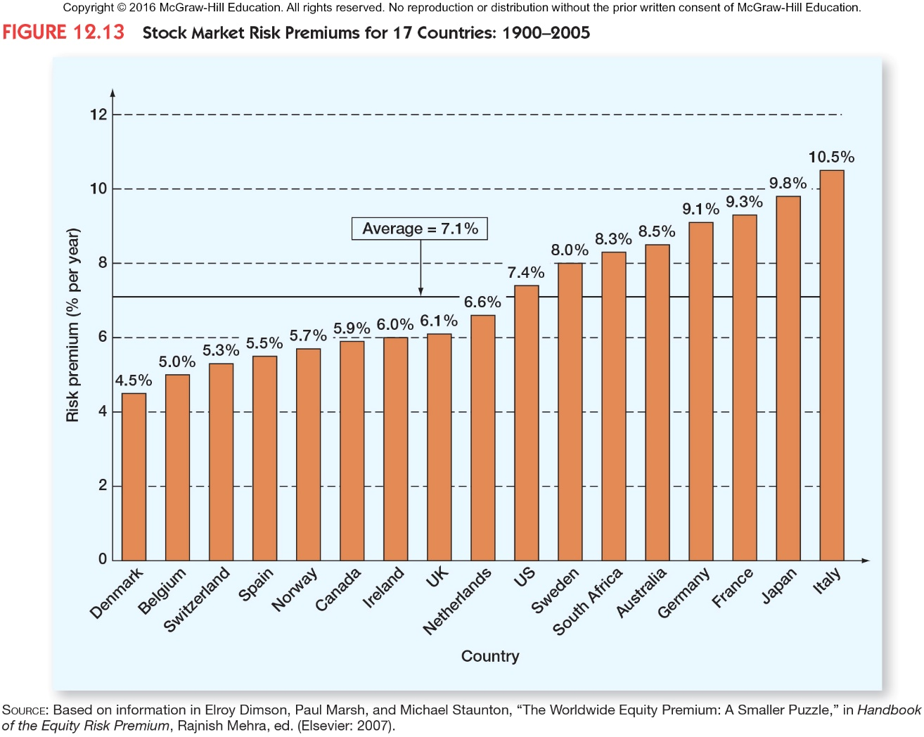

Overview: Risk, Return and Financial Markets

- Lessons from capital market history

- There is a reward for bearing risk

- The greater the potential reward, the greater the risk

- This is called the risk-return trade-off

How should we measure risk and return?

First Lesson: Average Return

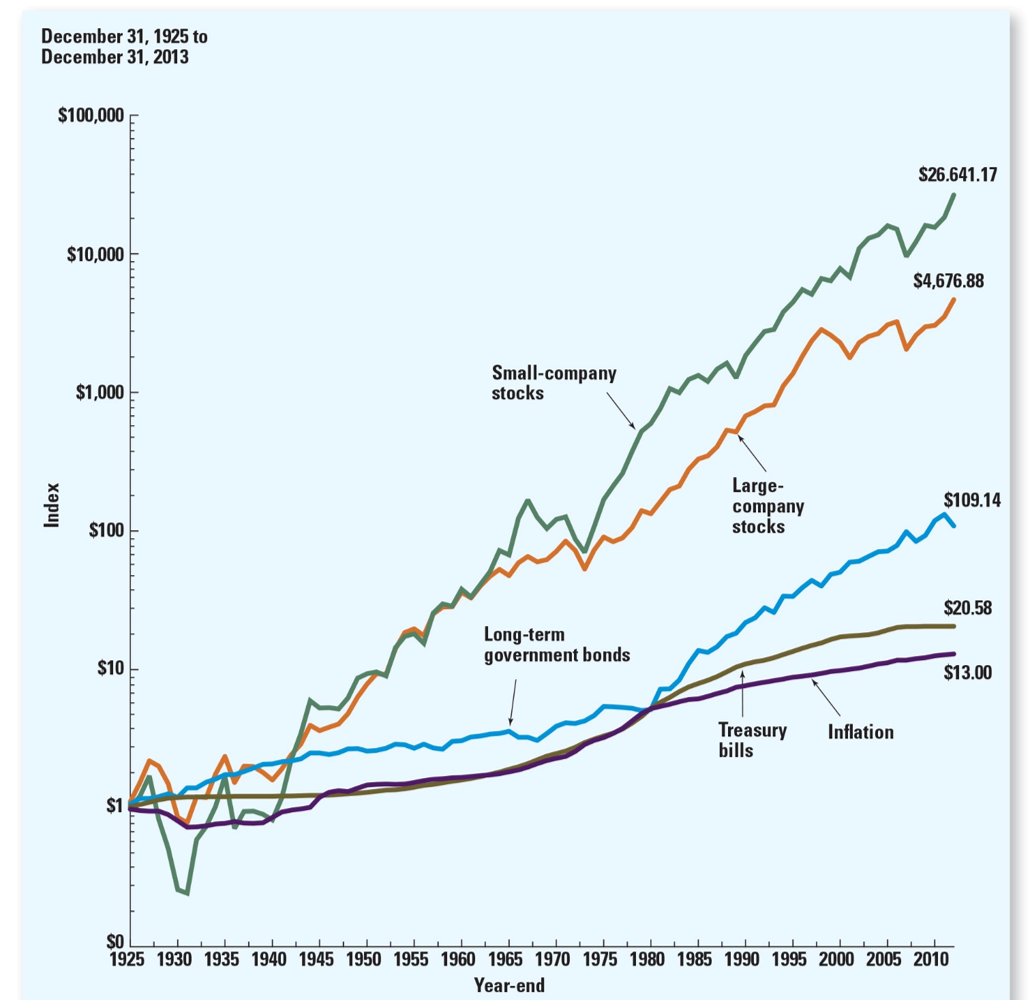

Historical Record

Ranking Returns

- Small cap stocks

- Large cap stocks

- Long-term government bonds

- Treasury Bills

- Inflation

Why wouldn't you just buy small cap stocks?

Calculating Returns

- Total Dollar Return

- $Return = Dividends + Capital Gains

- Total Percent Return

- %Return = $\frac{\$Return}{\$Invested}$

Example: Returns

You just invested in "You call that a Donut! Inc" for $\$$25, after one-year the price is $\$$35. Each share paid out a $\$$2 dividend. What was your total return?| Dollar Return | Percent Return | |

|---|---|---|

| Dividend | 2 | $\frac{2}{25}=8\%$ |

| Capital Gains | 35-25=10 | $\frac{35-25}{25}=40\%$ |

| Total Return | 2+10=12 | $\frac{10+2}{25}=48\%$ |

Percent Returns: Formulas

Dividend Yield$DY=\frac{D_{t+1}}{P_t}$

Capital Gains Yield

$CGY=\frac{P_{t-1}-P_t}{P_t}$

$\%Return=\frac{D_{t+1}+P_{t+1}-P_t}{P_t}$

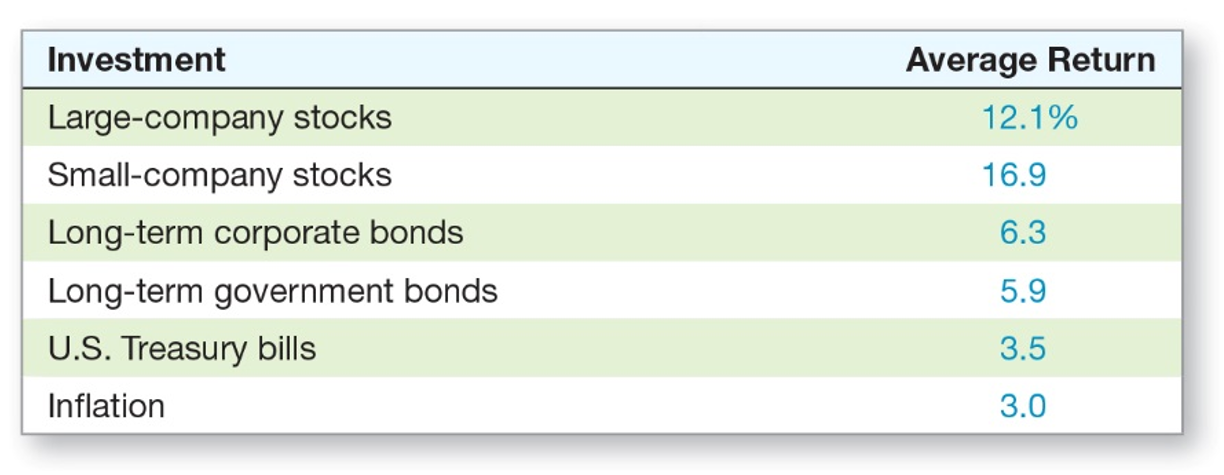

Historical Average Returns

$HistoricalAverageReturn=\frac{\sum\limits_{i=1}^TReturn_i}{T}$

Large cap stocks average return from 1926 to 2010: 11.9%

Your best guess about the size of the return for a year selected at random is 11.9%.

Historical Average Returns: 1926-2010

Practice: Average

Returns: -6, 8, 12, -15, 6Average = 1

Returns: -1, 2, -1, 1, 4

Average = 1

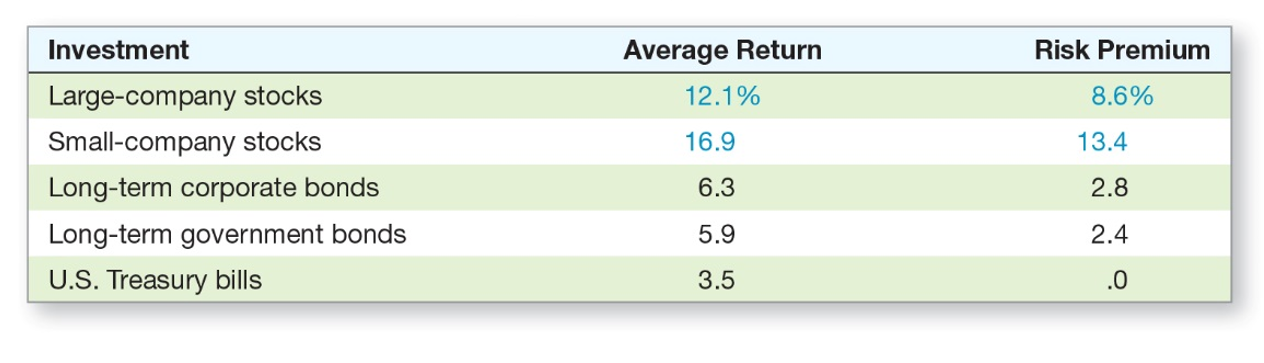

Risk Premium

U.S. Treasury bill is considered risk-free return

Historical Average Risk Premium

First Lesson Takeaways

Large company stocks have a historical average risk premium of 8.6%

What determines size of risk premium?

Second Lesson: Return Variability

Measuring Return Variability

- Variance or $\sigma^2$

- Common measure of return dispersion

- Standard deviation or $\sigma$

- Sometimes called volatility

- Same "units" as the average

Example

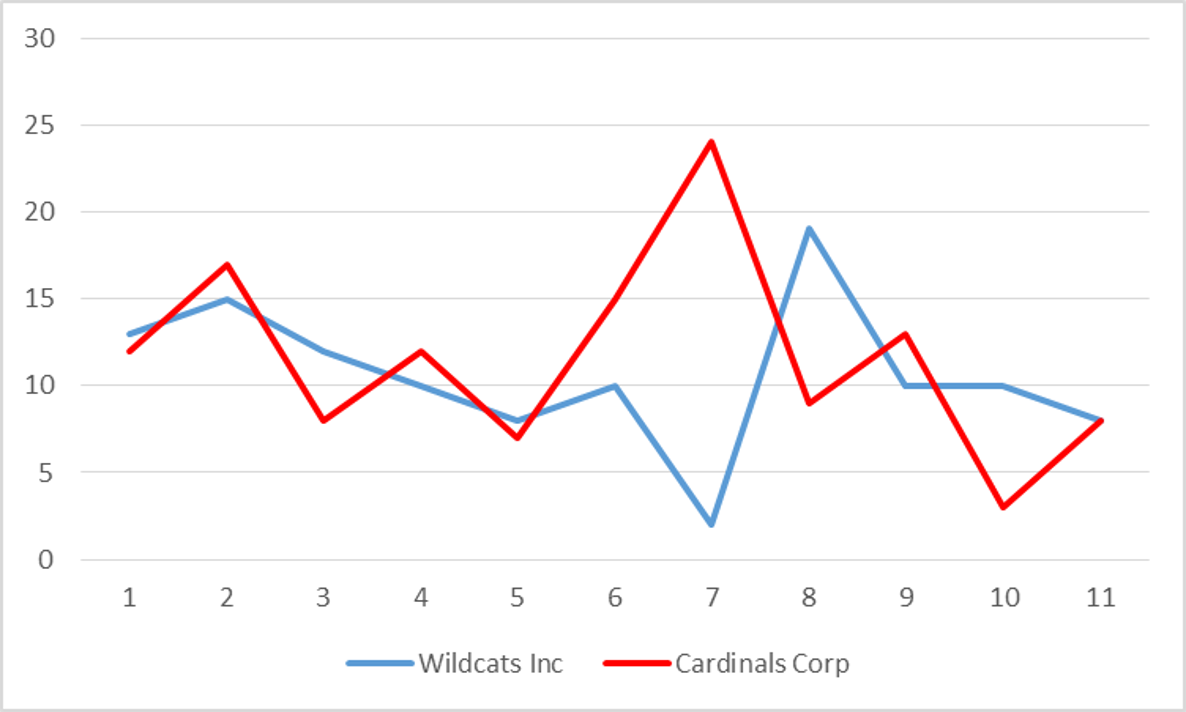

Two companies have the following returns:Wildcat Inc: 13,15,12,10,8,10,2,19,10,10,8

Cardinals Corp: 12,17,8,12,7,15,24,9,13,3,8

| Wildcats Inc. | Cardinals Corp. | |

|---|---|---|

| Average | 10.6 | 11.6 |

| Standard Deviation | 4.3 | 5.7 |

Graphical Representation

Steph vs LeBron (Points in 2016 Playoffs)

Steph Curry (9 games leading into finals):40,29,26,28,24,19,31,31,36.LeBron James (9 games leading into finals):27,24,21,24,23,24,29,23,33.

| Steph | LeBron | |

|---|---|---|

| Average | 29.33 | 25.33 |

| Standard Deviation | 6.25 | 3.71 |

Return Variability

- Return Variance:

$VAR(R)=\sigma^2=\frac{\sum\limits_{i=1}^T(R_i-\bar{R})^2}{T-1}$

- Standard deviation:

$STD(R)=\sigma=\sqrt{VAR(R)}$

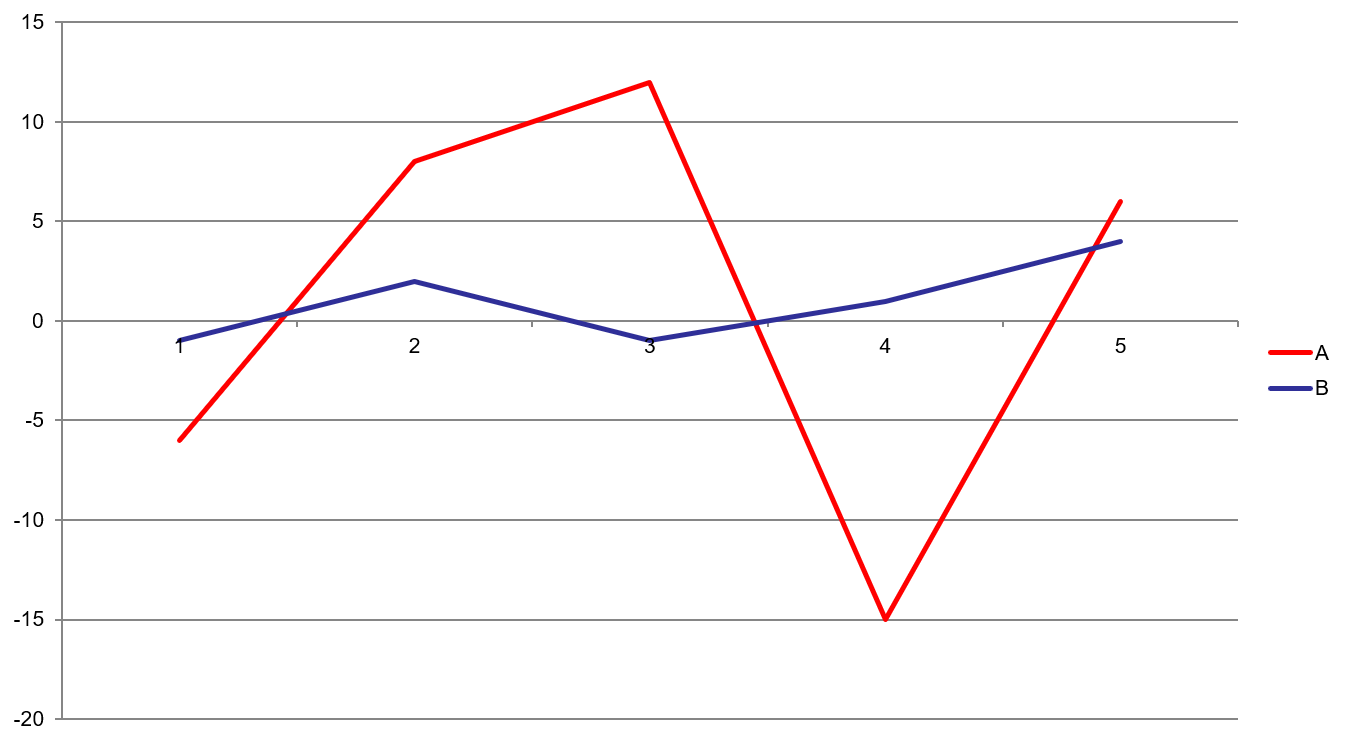

Practice: Standard Deviation

Returns(A): -6, 8, 12, -15, 6Average = 1

Standard deviation = 11.18

Returns(B): -1, 2, -1, 1, 4

Average = 1

Standard deviation = 2.12

Graphing Returns

Example

| Year | Return (%) | Average Return (%) | Difference | Squared Difference |

|---|---|---|---|---|

| 1926 | 11.14 | 11.48 | -.034 | 0.0012 |

| 1927 | 37.13 | 11.48 | 25.65 | 657.82 |

| 1928 | 43.31 | 11.48 | 31.83 | 1013.02 |

| 1929 | -8.91 | 11.48 | -20.39 | 415.83 |

| 1930 | -25.26 | 11.48 | -36.74 | 1349.97 |

| Variance | 859.19 | |||

| Standard Deviation | 29.31 |

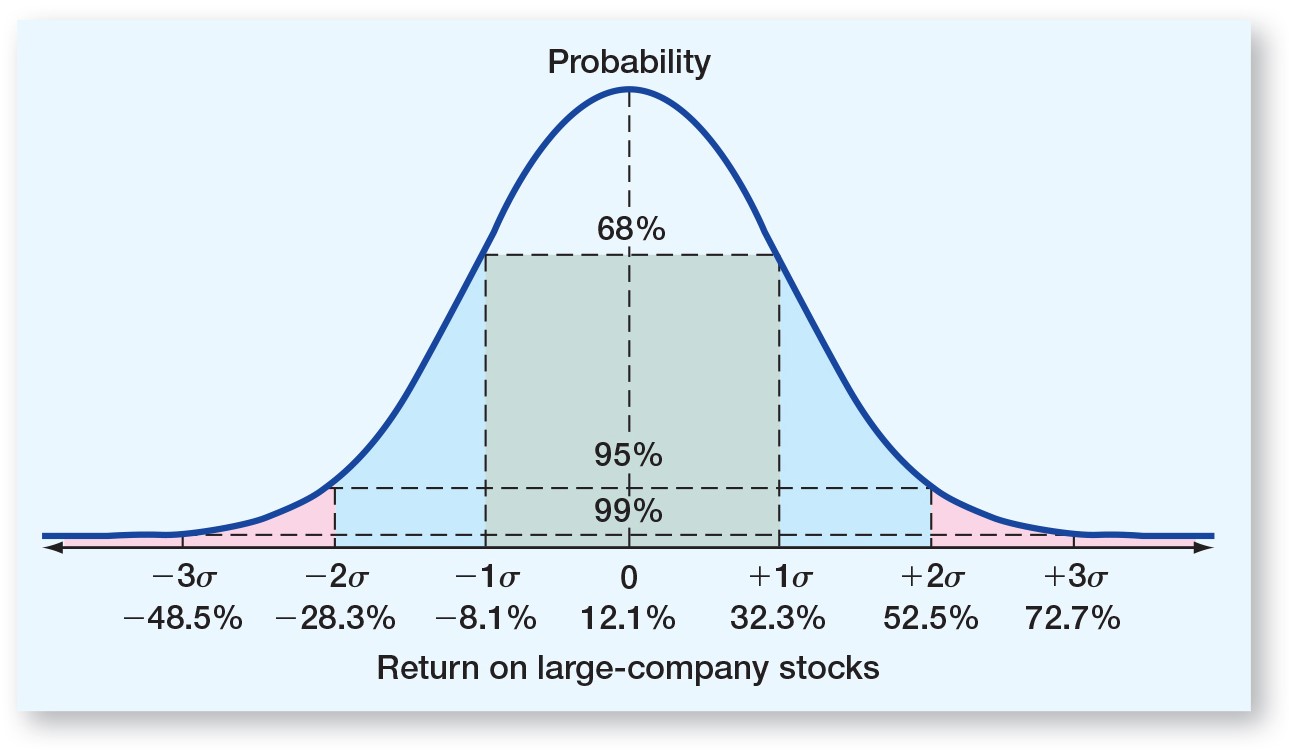

Normal Distribution

Arithmetic vs. Geometric Mean

Think about returns...

If you invest in a hedge fund that loses 20% the first year, but makes 20% the second year, are you back to even?- NO!!!!!

- Start with $\$$100

- After year 1: you have $\$$80

- After year 2, you have $96

Another example

Suppose you invest $\$$100 and it falls 50% in year one but gain 100% in year 2.- Year 0:100

- Year 1:100*(1-0.50)=50

- Year 2:50*(1+1)=100

Arithmetic vs. Geometric Mean

- Arithmetic average:

- Return earned in an average period over multiple periods

- Answers the question: "What was your return in an average year over a particular period?"

- Geometric average

- Average compound return per period over multiple periods

- Answers the question: "What was your average compound return per year over a particular period?"

Geometric average < Arithmetic average unless all the returns are equal

Geometric Average: Formula

$GAR=[(1+R_1)*(1+R_2)*...*(1+R_T)]^{\frac{1}{T}}-1$

Where:

$R_i$= return in each period

$T$ = number of periods

Geometric Average: Formula

$GAR=[\prod\limits_{i=1}^T(1+R_i)]^{\frac{1}{T}}-1$

Where:

$\prod$= Symbol for product (multiply)

$R_i$= return in each period

$T$ = number of periods in sample

Revisit Examples

If you invest in a hedge fund that loses 20% the first year, but makes 20% the second year.Average Return: 0%

Geometric return: -2.02%

Suppose you invest $\$$100 and it falls 50% in year one but gain 100% in year 2.

Average Return: 25%

Geometric Return: 0%

Example

| Year | Return (%) | (1+R) | Compounded |

|---|---|---|---|

| 1926 | 11.14 | 1.114 | 1.114 |

| 1927 | 37.13 | 1.3713 | 1.5241 |

| 1928 | 43.31 | 1.4331 | 2.1841 |

| 1929 | -8.91 | 0.9109 | 1.9895 |

| 1930 | -25.26 | 0.7474 | 1.4870 |

| $(1.4870)^\frac{1}{5}$ | 1.0826 | ||

| Geometric return | 8.26% |

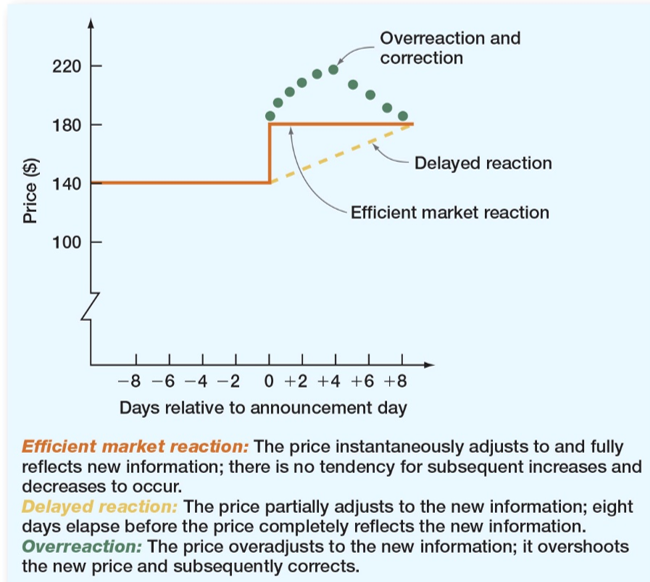

Capital Market Efficiency

Capital Market Efficiency

If true, cannot earn abnormal or excess returns.

Efficient Market Hypothesis

- Idea is competition among investors drives information into prices and thus the market becomes more and more efficient.

- Stocks are all priced correctly

Finance version of "Dad Joke"

A student and a finance professor are walking down the hall when they both see a $\$$20 bill on the ground. The student bends down to pick it up.The professor shakes their head slowly with a look of disappointment. And says…

"Don't bother, If it were really there, someone else would have picked it up already"

Forms of Market Efficiency

- Strong form: all information of every kind is reflected in the stock prices. Including public and private.

- Semi-strong form: all public information is reflected in stock prices.

- Weak form: Prices reflect all past trading information such as prices and volume.

Summary

- No simple way to "beat" the market

- Identifying mispriced stocks is very difficult (borderline impossible)

- Prices do respond rapidly to information

- Very difficult to predict future stock prices

Extra Practice

Example 1

One year ago, Avril purchased 3,600 shares of Lavigne stock for $\$$101,124. Today, she sold those shares for $\$$26.60 a share. What is the total return on this investment if the dividend yield is 1.7 percent?Example 2

A stock has yielded returns of 6 percent, 11 percent, 14 percent, and -2 percent over the past 4 years, respectively. What is the standard deviation of these returns?Example 3

You purchased 1,300 shares of LKL stock 5 years ago and have earned annual returns of 7.1 percent, 11.2 percent, 3.6 percent, -4.7 percent and 11.8 percent. What is your arithmetic average return?What is the geometric return?Key Learning Outcomes

- First Lesson: Average Returns

- Historical returns

- Risk Premium

- Second Lesson: Return Variability

- Standard deviation

- Arithmetic vs Geometric return

- Capital market efficiency

- Efficient market hypothesis