Return, Risk, and the Security Market Line

Chapter 13

Created by David Moore, PhD

Topics

- Expected Returns and Variances

- Portfolios

- Diversification

- Total, systematic, unsystematic risk

- Beta

- Reward-to-risk Ratio

- Security Market Line

- CAPM

Expected Returns and Variances

Weighted Average Reminder

Your grade is weighted 30% for the midterm 50% for the final. Homework is worth 10% and quizzes another 10%. You did perfect on the homework and quizzes. The midterm you received a 81 and the final was an 92. What is your final grade?Answer: 90.3

Expected Returns

- Expected returns are based on the probabilities of possible outcomes

- In this context, "expected" means average if the process is repeated many times

- The "expected" return does not even have to be a possible return

$E(R)=\sum\limits_{i=1}^Np_iR_i$

Example: E(R)

Suppose you have predicted the following returns for stocks C and T in three possible states of the economy. What are the expected returns?| State | Probability | C | T |

|---|---|---|---|

| Boom | 0.3 | 0.15 | 0.25 |

| Normal | 0.5 | 0.1 | 0.2 |

| Recession | ??? | 0.02 | 0.01 |

| Expected Return | 9.9% | 17.7% |

Variance and Standard Deviation

- Variance and standard deviation measure the volatility of returns

- Using unequal probabilities for the entire range of possibilities

- Weighted average of squared deviations

$\sigma^2=\sum\limits_{i=1}^np_i(R_i-E(R))^2$

Example

| State | $P_i$ | C | T | $p_i(R_i-E(R))^2$ | $p_i(R_i-E(R))^2$ |

|---|---|---|---|---|---|

| Boom | 0.3 | 0.15 | 0.25 | $0.3(0.15-0.099)^2$ | $0.3(0.25-0.177)^2$ |

| Normal | 0.5 | 0.1 | 0.2 | $0.5(0.1-0.099)^2$ | $0.5(0.2-0.177)^2$ |

| Recession | 0.2 | 0.02 | 0.01 | $0.2(0.02-0.099)^2$ | $0.2(0.01-0.177)^2$ |

| $\sigma^2$ | 0.002029 | 0.007441 | |||

| $\sigma$ | 4.50% | 8.63% |

Portfolios

What is a portfolio?

- A portfolio is a collection of assets

- An asset's risk and return are important in how they affect the risk and return of the portfolio

- The risk-return trade-off for a portfolio is measured by the portfolio expected return and standard deviation, just as with individual assets

Portfolio Weights

Suppose you have $\$$15,000 to invest and you have purchased securities in the following amounts. What are your portfolio weights in each security?| Portfolio | Weights |

|---|---|

| $\$$2000 of DIS | 2/15=13.33% |

| $\$$3000 of KO | 3/15=20% |

| $\$$4000 of AAPL | 4/15=26.7% |

| $\$$6000 of PG | 6/15=40% |

Portfolio Expected Return

$E(R_p)=\sum\limits_{j=1}^mw_jE(R_j)$

- You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities

Example

| Stock | Weight | Return | $w_jE(R_j)$ |

|---|---|---|---|

| DIS | .1333 | 19.69% | 2.62% |

| KO | .20 | 5.25% | 1.05% |

| AAPL | .267 | 16.65% | 4.45% |

| PG | .40 | 18.24% | 7.30% |

| $E(R_p)$ | 15.41% |

Portfolio Variance

- Compute the portfolio return for each state.

- Compute the expected portfolio return using the same formula as for an individual asset.

- Compute the portfolio variance and standard deviation using the same formulas as for an individual asset.

Example

| State | $P_i$ | A (50%) | B (50%) | $E(R_p)$ | $p_i(E(R_j)-E(R_p))^2$ |

|---|---|---|---|---|---|

| Boom | .4 | 30% | -5% | 12.5% | $.4(12.5-9.5)^2=3.6$ |

| Bust | .6 | -10% | 25% | 7.5% | $.6(7.5-9.5)^2=2.4$ |

| $E(R_i)$ | 6% | 13% | $E(R_p)$9.5% | $\sigma_p^2$=6 | |

| $\sigma_i^2$ | 384 | 216 | $\sigma_p$=2.45% | ||

| $\sigma_i$ | 19.6% | 14.7% |

Note: You CANNOT use stock level $\sigma^2$ and $\sigma$ to calculate portfolio.

Risk, Return, and Diversification

Systematic Risk

- Risk factors that affect a large number of assets

- Also known as non-diversifiable risk or market risk

- Includes such things as changes in GDP, inflation, interest rates, etc.

Unsystematic Risk

- Risk factors that affect a limited number of assets

- Also known as unique risk and asset-specific risk

- Includes such things as labor strikes, part shortages, etc.

Returns

$Total Return = Expected Return + Unexpected Return$$Unexpected Return = Systematic Portion $

$+ Unsystematic Portion$

$Total Return= Expected Return + Systematic Portion$

$+ Unsystematic Portion$

Diversification

- Diversification is not just holding a lot of assets

- For example, if you own 50 Internet stocks, you are not diversified

- However, if you own 50 stocks that span 20 different industries, then you are diversified

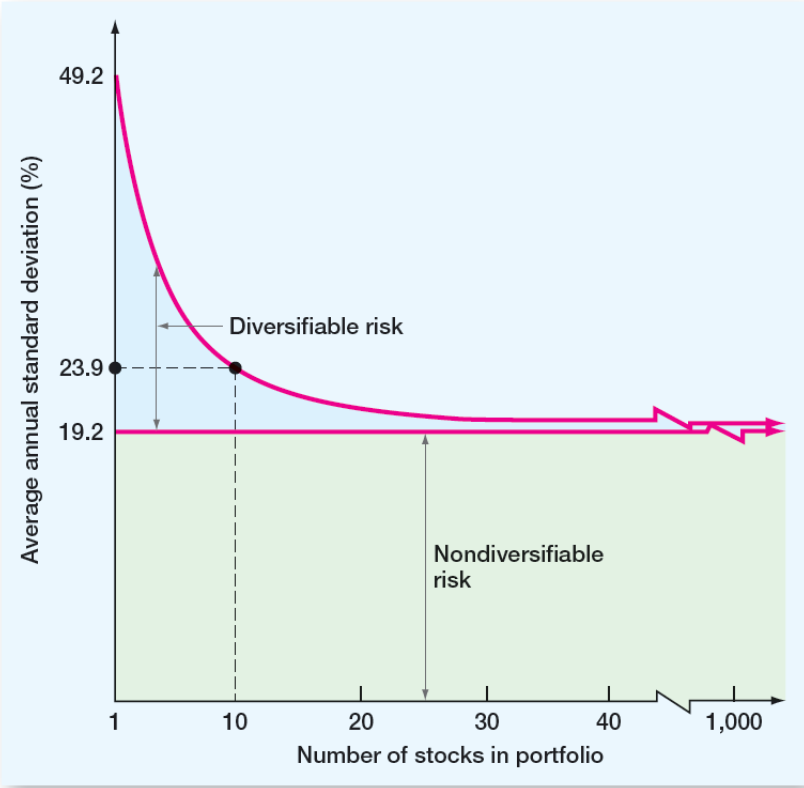

The Principle of Diversification

- Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns

- This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another

- However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion

Diversifiable vs Non-Diversifiable Risk

Diversifiable Risk

- The risk that can be eliminated by combining assets into a portfolio

- Often considered the same as unsystematic, unique or asset-specific risk

- If we hold only one asset, or assets in the same industry, then we are exposing ourselves to risk that we could diversify away

Total Risk

- The standard deviation of returns is a measure of total risk

- For well-diversified portfolios, unsystematic risk is very small

- Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk

Systematic Risk Principle

Measuring Systematic Risk

- How do we measure systematic risk?

- We use the beta coefficient

- What does beta tell us?

- A beta of 1 implies the asset has the same systematic risk as the overall market

- A beta < 1 implies the asset has less systematic risk than the overall market

- A beta > 1 implies the asset has more systematic risk than the overall market

Current Beta's

Total vs. Systematic Risk

Consider the following information:| Standard Deviation | Beta | |

|---|---|---|

| Marathon Oil | 20% | 3.13 |

| Exxon Mobil | 30% | 0.69 |

- Which security has more total risk? Exxon Mobil

- Which security has more systematic risk? Marathon Oil

- Which security should have the higher expected return? Marathon Oil

Portfolio Beta

Consider the previous example with the following four securities| Security | Weight | Beta |

|---|---|---|

| DIS | .133 | 1.444 |

| KO | .2 | 0.797 |

| AAPl | .267 | 1.472 |

| PG | .4 | 0.647 |

What is the portfolio beta?

.133(1.444) + .2(0.797) + .267(1.472) + .4(0.647) = 1.003

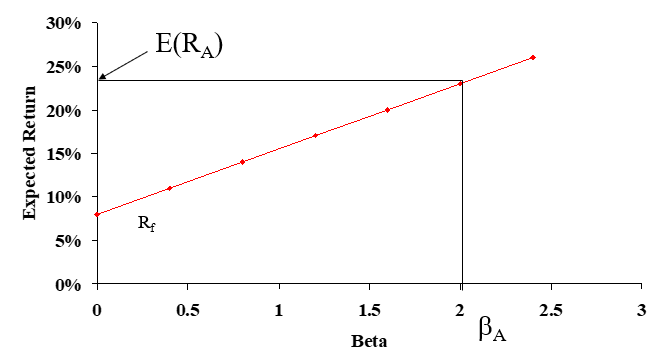

Portfolio Expected Returns and Betas

Reward-to-Risk Ratio

- The reward-to-risk ratio is the slope of the line illustrated in the previous example

- $Slope=\frac{E(R_A)-R_f}{\beta_A-0}$

- From graph, $Slope=\frac{23-8}{2-0}=7.5$

- What if an asset has a reward-to-risk ratio of 8 (implying that the asset plots above the line)?

- What if an asset has a reward-to-risk ratio of 7 (implying that the asset plots below the line)?

Market Equilibrium

$\frac{E(R_A)-R_f}{\beta_A}=\frac{E(R_M)-R_f}{\beta_M}$

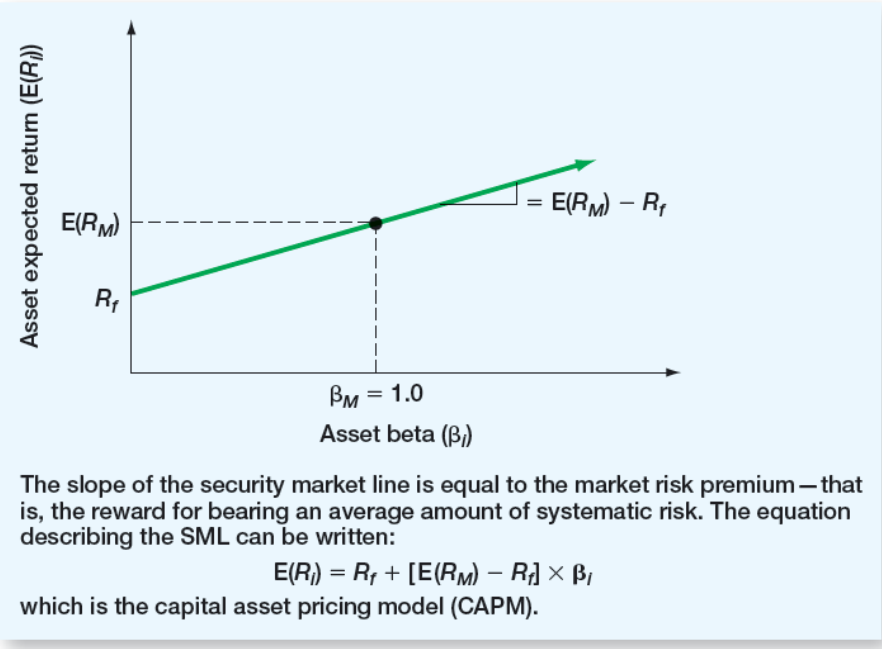

Security Market Line

- The security market line (SML) is the representation of market equilibrium

- The slope of the SML is the reward-to-risk ratio: $\frac{E(R_M)-R_f}{\beta_M}$

- But since the beta for the market is always equal to one, the slope can be rewritten

- Slope $=E(R_M) – R_f =$ market risk premium

Put it all together...

The Capital Asset Pricing Model (CAPM)

$E(R_i)=R_f+\beta_i(E(R_M)-R_f)$

- If we know an asset's systematic risk, we can use the CAPM to determine its expected return

- This is true whether we are talking about financial assets or physical assets

Factors Affecting Expected Return

- Pure time value of money: measured by the risk-free rate

- Reward for bearing systematic risk: measured by the market risk premium

- Amount of systematic risk: measured by beta

CAPM: Example

Consider the betas for each of the assets given earlier. If the risk-free rate is 4.15% and the market risk premium is 8.5%, what is the expected return for each?| Asset | Beta | $E(R_i)$ |

|---|---|---|

| DIS | 1.444 | 4.15 + 1.444(8.5) = 16.42% |

| KO | 0.797 | 4.15 + 0.797(8.5) = 10.92% |

| AAPL | 1.472 | 4.15 + 1.472(8.5) = 16.66% |

| PG | 0.647 | 4.15 + 0.647(8.5) = 9.65% |

Extra Practice

Example 1

What is the expected return, variance, and standard deviation?| State | Probability | Go Nuts for Donuts Inc. |

|---|---|---|

| Boom | .25 | .15 |

| Normal | .5 | .08 |

| Slowdown | .15 | .04 |

| Recession | .10 | -.03 |

Example 2

Consider the following information on returns and probabilities:| State | Probability | Apple | Disney |

|---|---|---|---|

| Boom | .25 | 15% | 10% | Normal | .6 | 10% | 9% |

| Recession | .15 | 5% | 10% |

What are the expected return and standard deviation for a portfolio with an investment of $\$$6,000 in Apple and $\$$4,000 in Disney?

Example 3

The risk free rate is 4%, and the required return on the market is 12%.- What is the required return on an asset with a beta of 1.5?

- What is the reward/risk ratio?

- What is the required return on a portfolio consisting of 40% of the asset above and the rest in an asset with an average amount of systematic risk?

Key Learning Outcomes

- Calculate:

- Expected return, variance, and standard deviation

- Do so for a portfolio of assets

- Understand diversification

- Total risk, Systematic risk, Unsystematic risk

- Beta, Security Market Line and CAPM

- Understand concept and derivation

- Calculate Portfolio Beta

- Use CAPM