CBA Night At The Movies

Payday

Created by David Moore, PhD

Topics

- Short-term Liquidity

- Payday loans: facts and figures

- Payday Loans: Academics

- Solutions

- Regulation

- Innovation

- Financial Literacy

Short-term Liquidity

Cost of Living

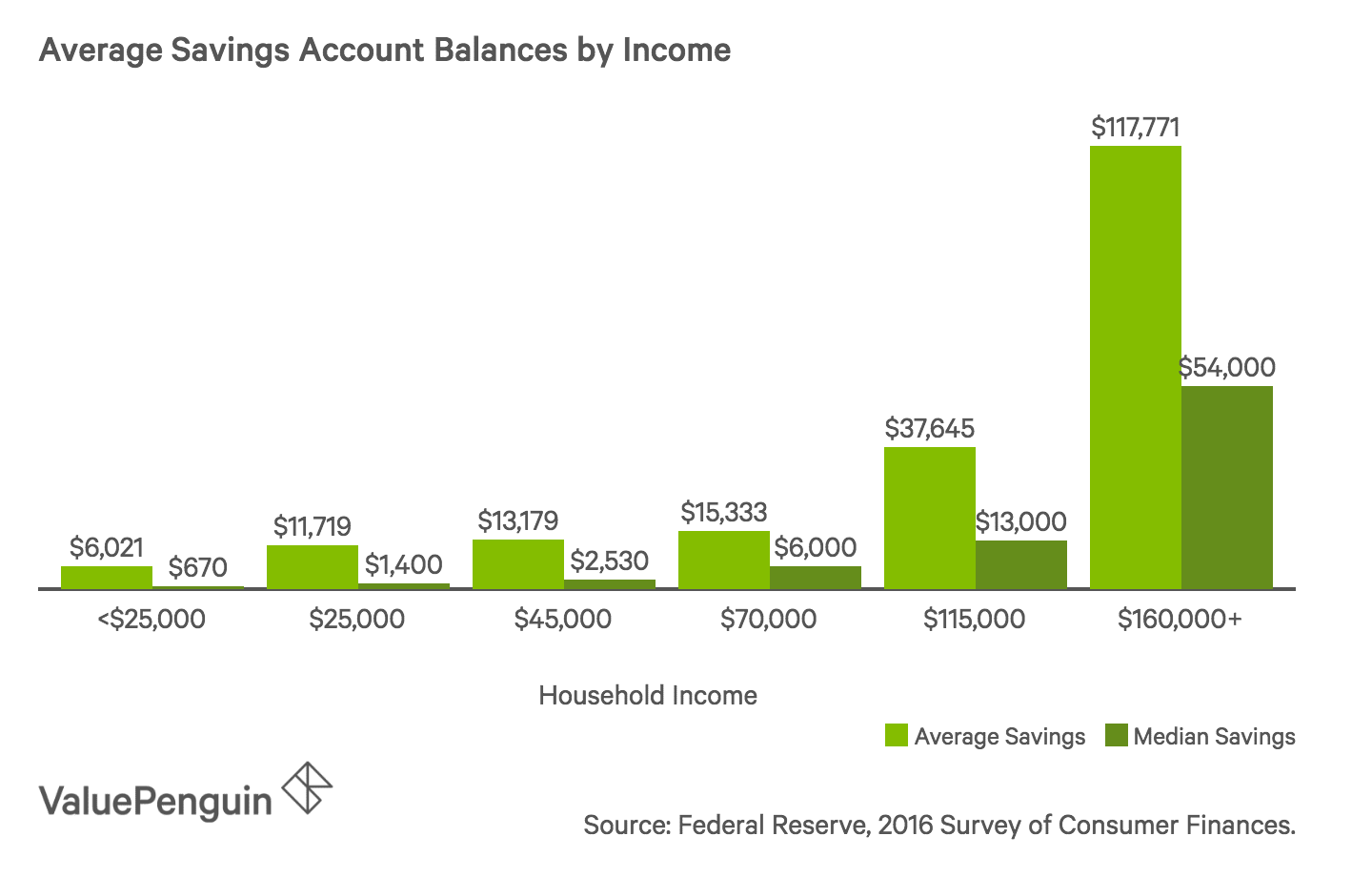

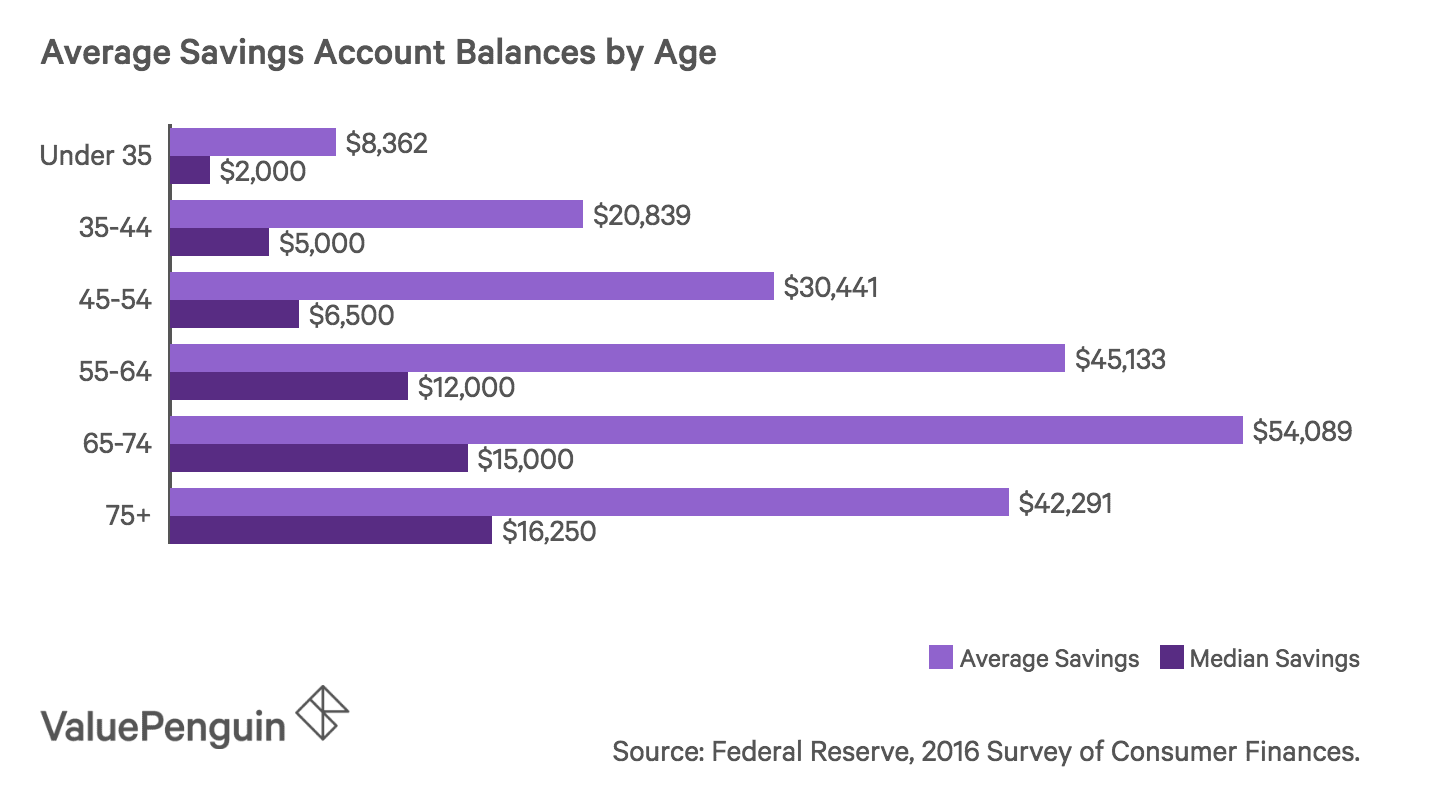

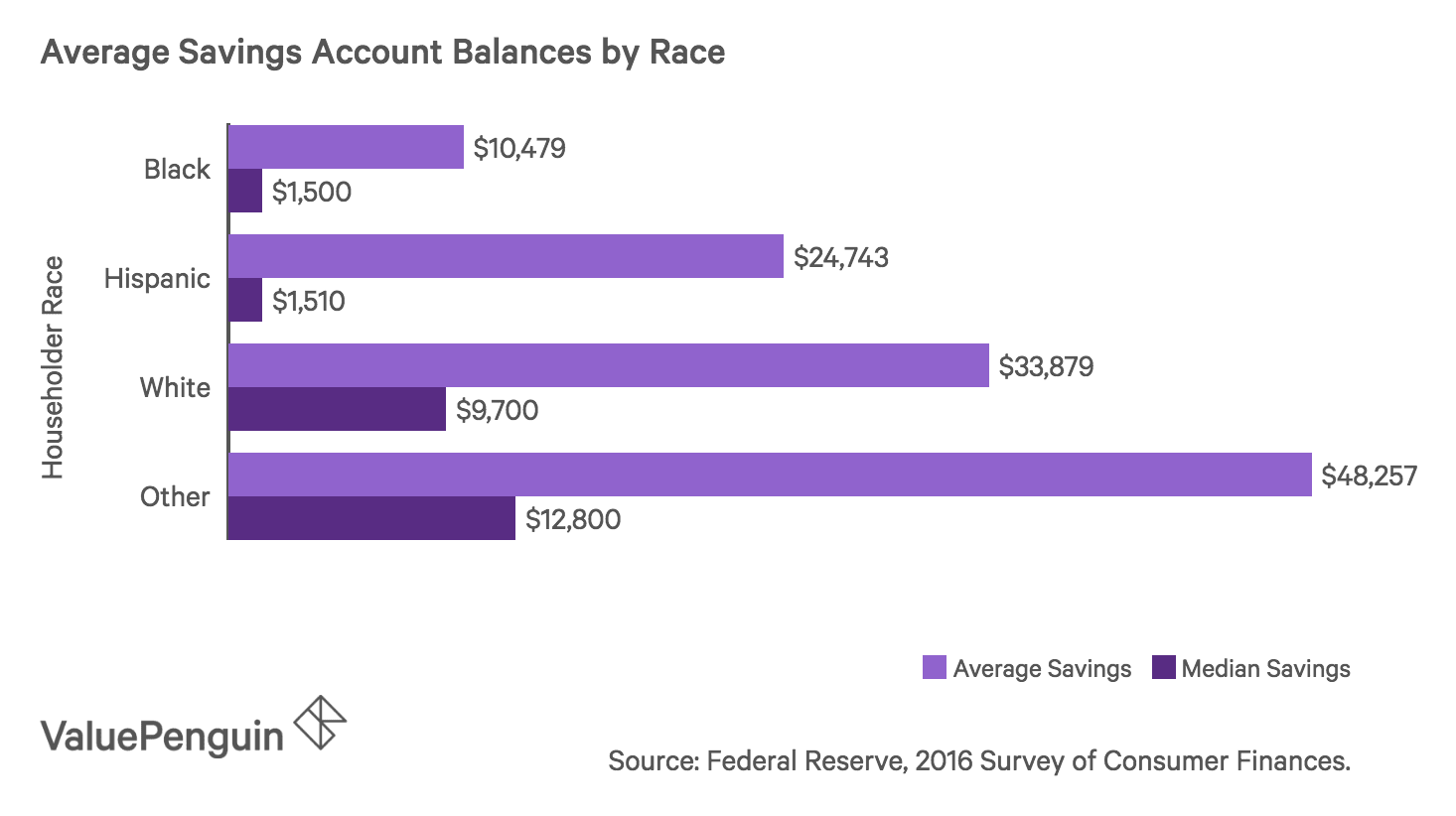

What's in Savings?

What's in Savings?

What's in Savings?

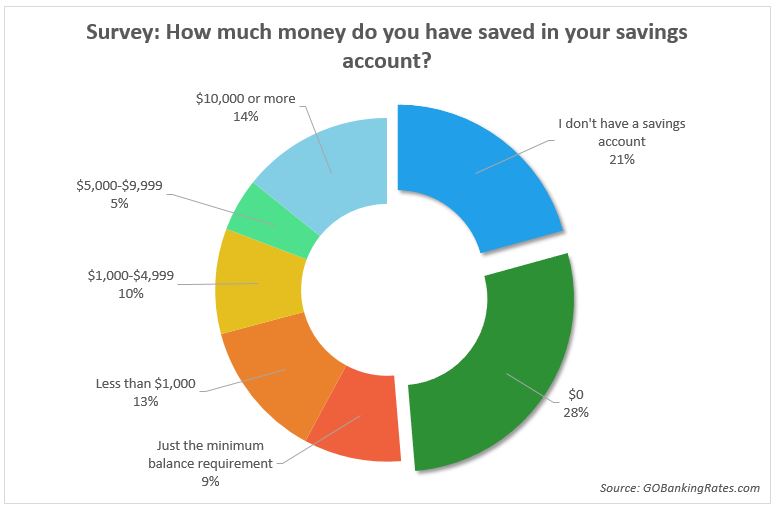

More on Savings

Financial Shock

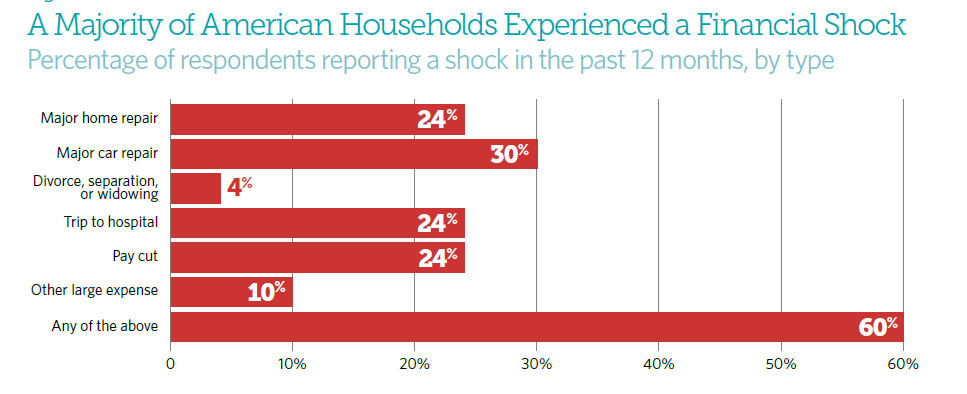

Financial Shock: Frequency

Source: Pew's Survey of American Family Finances

Source: Pew's Survey of American Family Finances

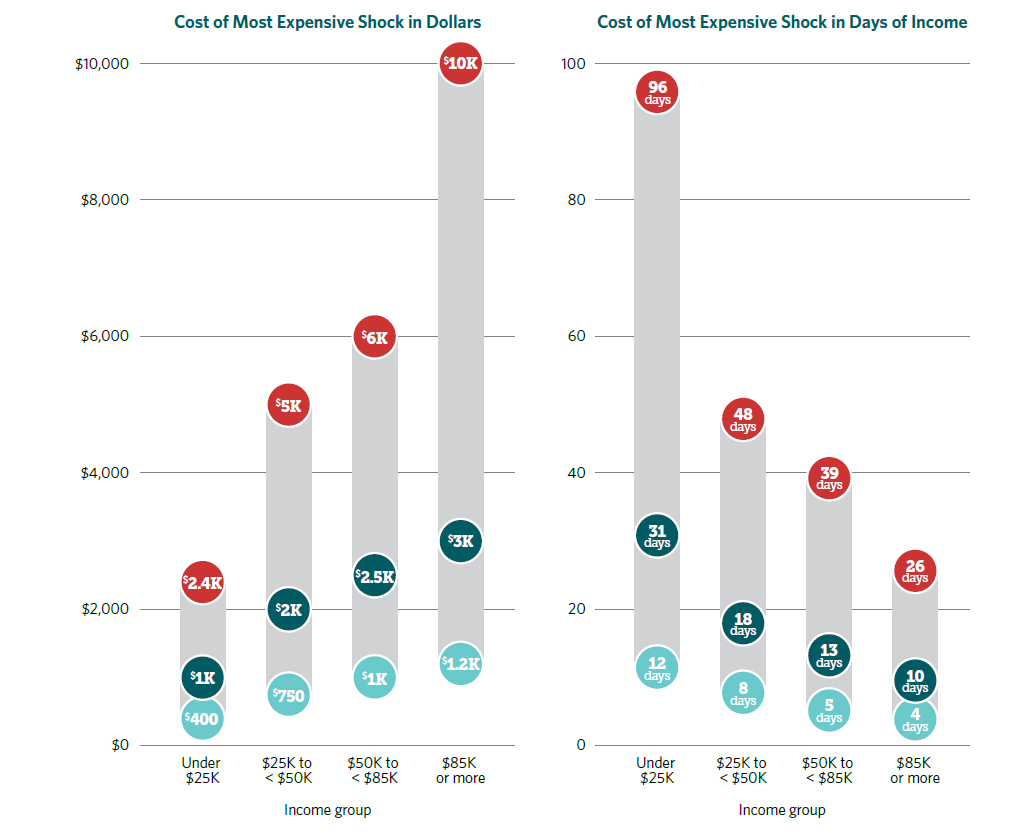

Financial Shock: Cost

Source: Pew's Survey of American Family Finances

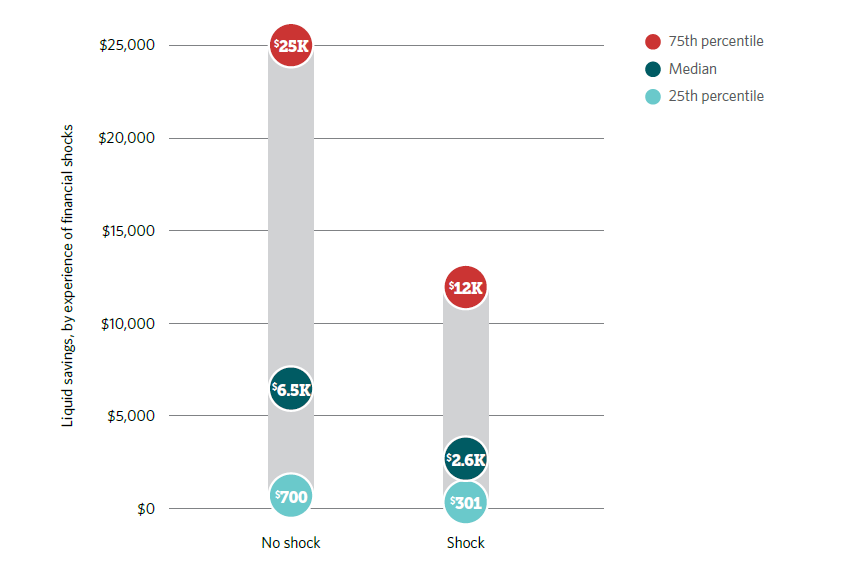

Financial Shock: Ability to Cope

Source: Pew's Survey of American Family Finances

Payday Loans

Facts and Figures

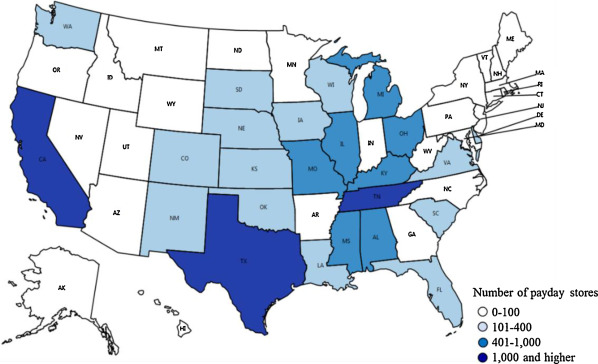

- More payday offices than McDonald's (as of 2014)

- Number of payday loan borrowers each year: 12 million

- Average income for payday loan borrower: $30,000 annually

- 7 in 10 borrowers use them for regular, recurring expenses such as rent and utilities.

- Payday lenders have direct access to a borrower's checking account on payday

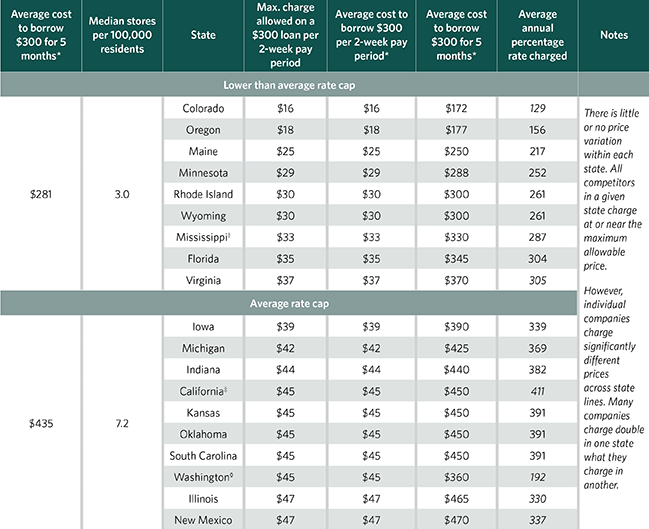

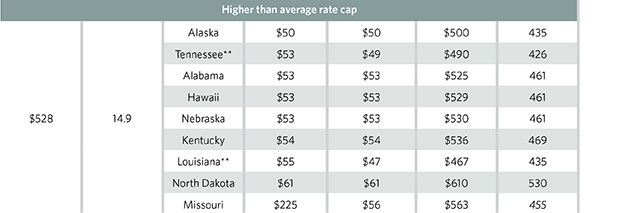

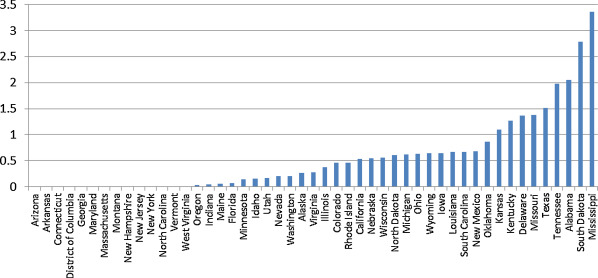

- Payday loans are available in 36 states, with annual percentage rates averaging 391 percent.

Facts and Figures

The average payday loan borrower:- In debt for five months of the year

- Pays an average of $\$$520 in fees to repeatedly borrow $\$$375

- Requires a lump-sum repayment of $430 on the next payday (36% gross paycheck)

- Most borrowers can afford no more than 5 percent while still covering basic expenses.

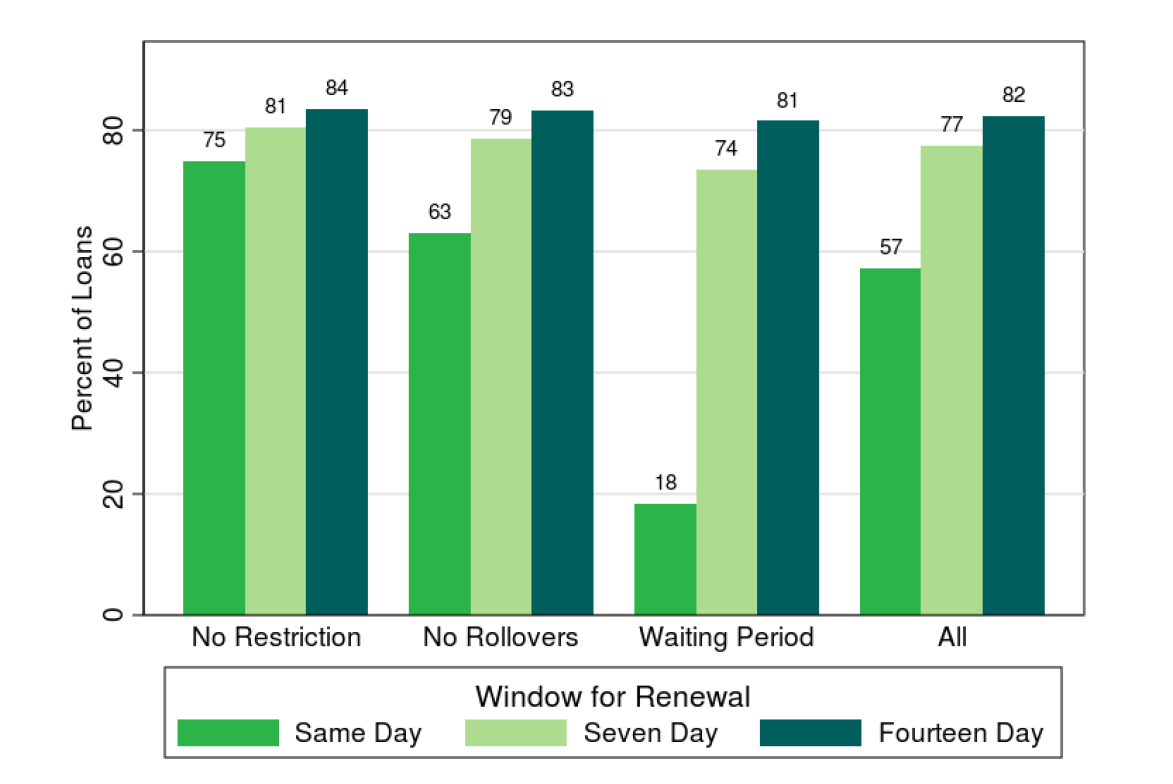

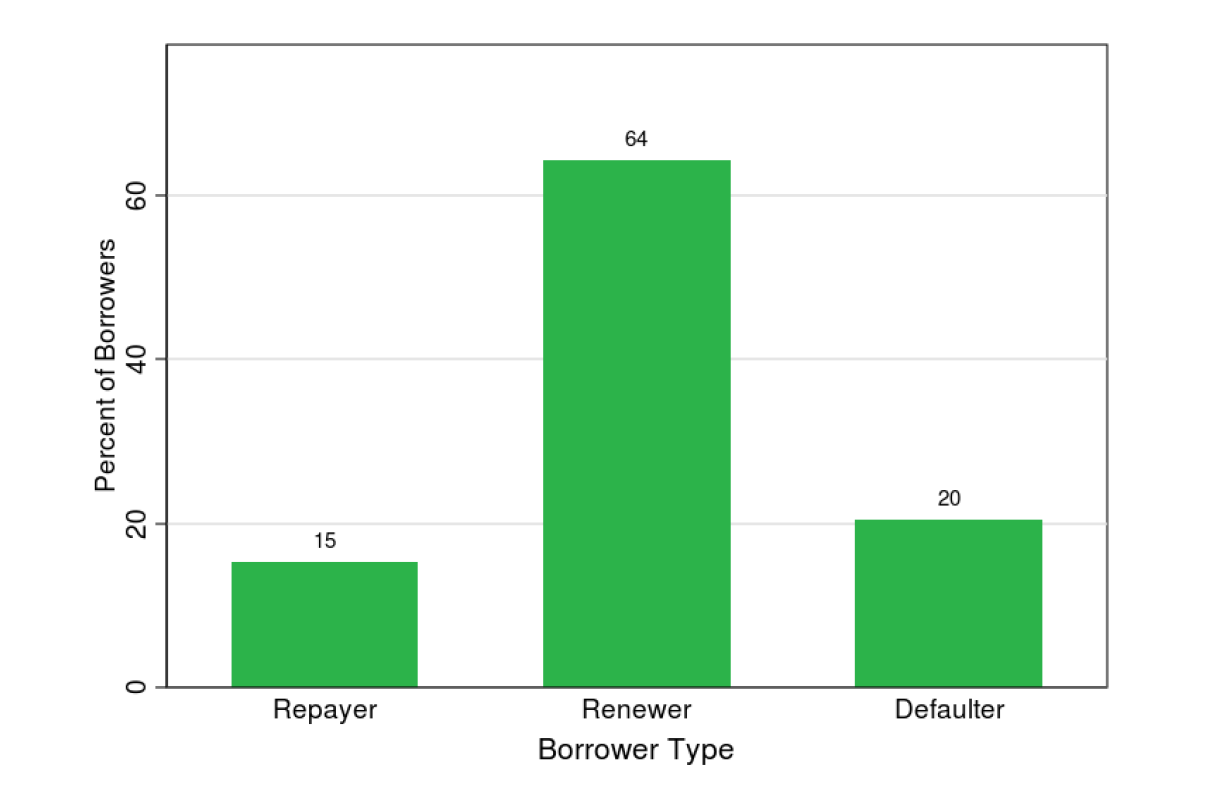

Renewals...Scary

Repay, Renew, or Default

Are payday loans "heroes" or "villains"?

Theory

- Heroes:credit access boosts household utility by allowing users to smooth consumption over shocks (Friedman 1956)

- Villains: worsens well-being for households with unusually strong preferences for current consumption (Laibson 1997) and overoptimism/inattention about future prospects (Mann 2013).

- Debt-trap: repeated borrowing at high rates exacerbates financial distress.

Answer...Both

Empirical research is very much mixed.

Welcome to the world of empirical research :)

Evidence for Hero (no effect)

- Payday loans mitigate financial distress, i.e., smooth negative shocks (Morse, 2011; Dobridge 2016; Wilson et al. 2010; Zinman 2010; Morgan, Strain, and Seblani 2012)

- No effect on credit scores, delinquencies, likelihood of overdrawing.(Bhutta 2014; Bhutta, Skiba and Tobacman 2015; and Desai and Elliehausen, 2016; Hynes 2012)

- Racial composition does not effect store location (Bhutta 2014)

Evidence for Villain

- In an average period access to payday credit reduces well-being (Dobridge 2016)

- Banning payday loans reduces liquor sales (Cuffe and Gibbs 2015)

- Racial composition influences store location (Barth, Hilliard, and Jahera 2015; Barth, Hilliard, Jahera, and Sun 2016)

- Increase in bankruptcy and financial distress (Skiba and Tobacman 2011; Morgan, Strain, and Seblani 2012;Melzer 2011; Campbell, Tufano, and Martinez-Jerez 2012)

- Decline in job performance and retention, stronger in inexperience and unsophisticated (Carrell and Zinman 2016)

Solutions

- Regulation

- Innovation

- Financial Literacy

Regulation

- Require longer repayment periods

- See Colorado regulation

- Increased disclosure

Innovation

- New company like Earnin app

- How viable is "tipping" model?

- Can technology reduce origination fee?

Financial Literacy

Go to live.voxvote.com PIN: 14105

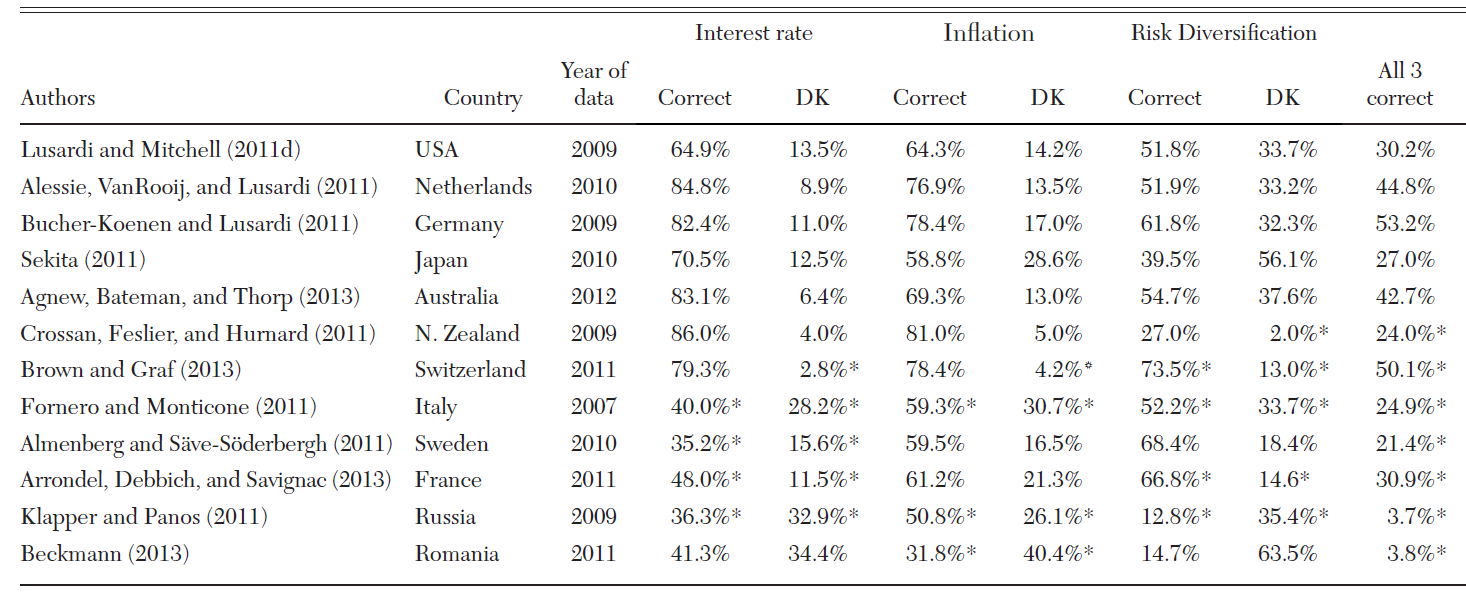

Stats on Literacy

Source: Lusardi and Mitchell 2014

2015 NFC Study

- National: Q1:75% Q2:59% Q3:46% (N=27564)

- California:Q1:70% Q2:53% Q3:42% (N=1000)

- 3.16/6 Mean number of correct quiz answers

- 76% of assess own financial knowledge as high (5-7 on 7 point scale)

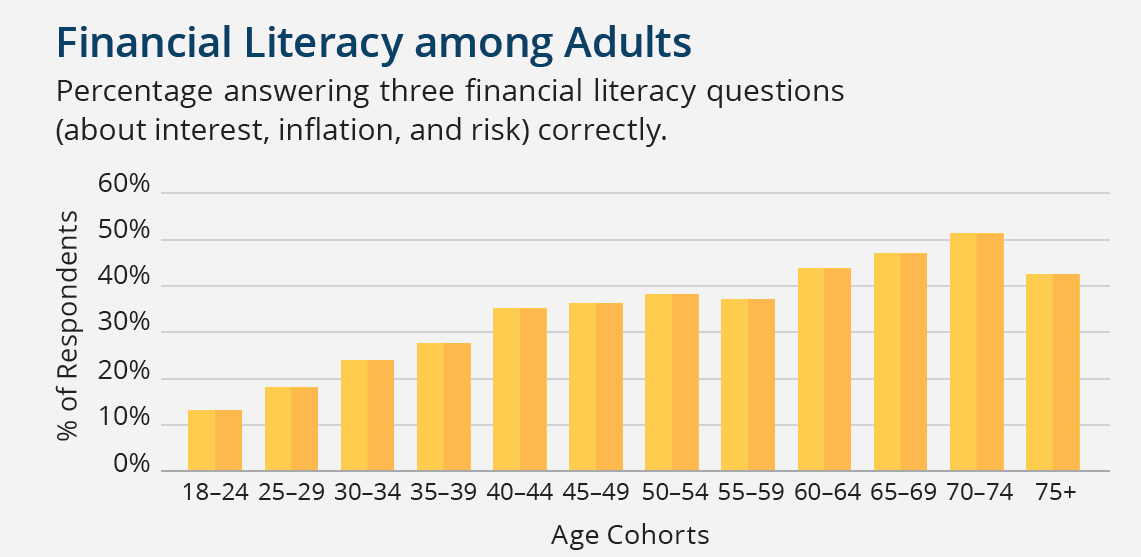

Literacy by Age Group

Source: GFLEC

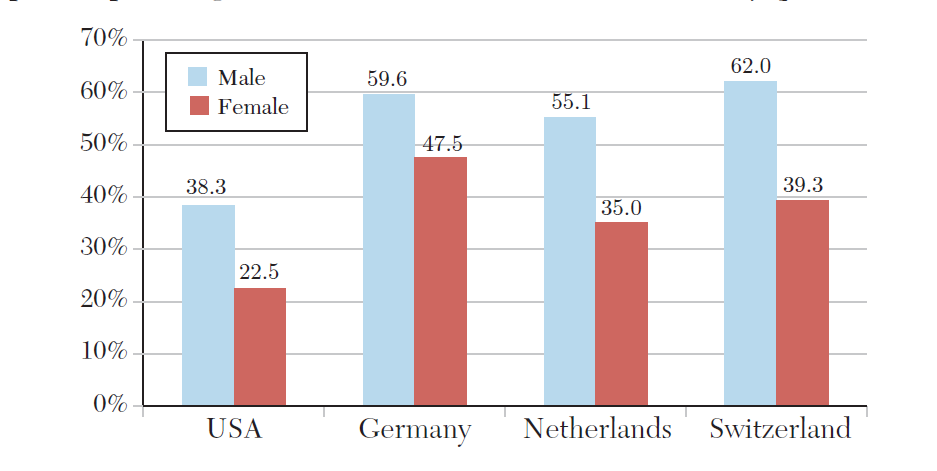

Literacy by Sex

Source: Lusardi and Mitchell 2014

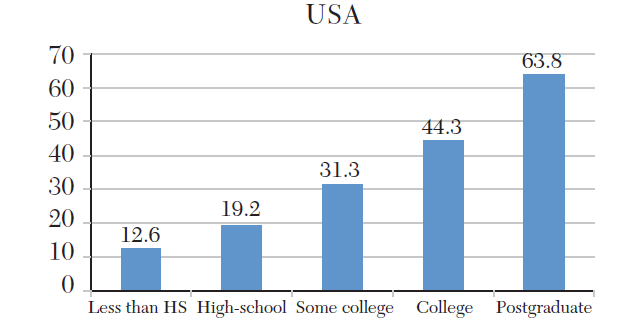

Literacy by Education

Source: Lusardi and Mitchell 2014

Does Literacy help?

Financial literacy is correlated with (plausibly causal):- Retirement planning

- More sophisticated investment behavior

- Making good borrowing decisions

Source: Survey paper by Xu and Zia 2012

Issues with Teaching Literacy

- Mixed results on long-term efficacy of teaching financial literacy

- Unclear the best "way" to teach literacy

- Debate on measuring outcomes and rigor of studies

- More research to be done here

Source: GFLEC