Careers in Finance

Created by David Moore, PhD

Data for presentation primarily sourced from Wall Street Prep

Topics

- About me

- Why FNCE 1401?

- Why are you interested in Finance?

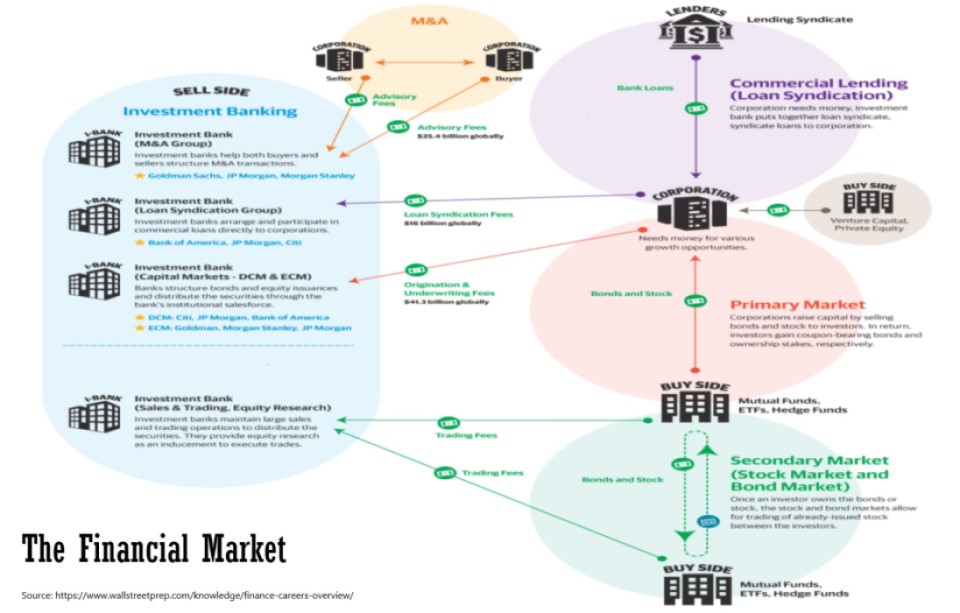

- The Finance Industry

- Sell Side vs Buy Side

- Career paths and specific jobs

- Importance of Internships

- Resources and Activities at LMU

- Post-Grad Education and Certification

About me

What do I Teach?

- FNCE 3415: Valuation and Financial Modeling

- We use Excel to build models that help us value assets.

- Building block of skills required in majority of finance careers.

- Required course typically taken in Fall of Junior year. (Take it sooner if you can)

View my Course

Why FNCE 1401?

- Getting internships early can set you up for success.

- Thinking about what career path lines up with your strengths, skills, and interests.

- Put you on track to a successful experience at LMU as a finance major.

Skills and Traits

- Almost all finance jobs require a similar skill set

- Fundamental knowledge of finance, Excel, Good communication/presentations skills, analytical

- Some jobs are more client facing ("sales") and other jobs are more analytical ("behind the scenes")

- As you move up in most industries there will be much more client facing/relationship building than analytical/behind the scenes

- What career you choose depends on your strengths, weaknesses, skills, and interests.

Sell Side

- Primarily the investment banking industry

- Multiple "sectors"

- Primarily generate revenue through fees

Investment Banking 101

- Types of Banks

- Hard Skills: Fundamentals of Finance, Modeling and Valuation, Excel (Master), Presentation (Power Point), Bloomberg Terminal (sales and trading)

- Soft Skills: Analytical, Discipline, Creativity, Interpersonal/Relationship building, Communication

Back to Career Mapping

Bulge Bracket Firms

Back to Investment Banking 101

Boutique Bracket Firms

Back to Investment Banking 101

Regional Firms

Back to Investment Banking 101

Salary and Career Path

- Starting Salary: $70-110k

- Signing Bonus: 0-10k

- Year-end Bonus: 70-100k

- Most 1st year analyst average total compensation is 190k

- Promotion and Salary

- Associate ("a to a"): Typically after 2 years as Analyst

- Base:150k>175k>200k. Bonus:90-130k>100-215k>120k-250k

- Vice-president: Base:250-300k; Bonus:200-400k

- Director: Base:300-350k; Bonus:400-600k

- Managing Director: Base:350k-600k Bonus:100-200%

Recent updates in Salary

M&A Group

- Within M&A there is a buy-side (the acquirer) and sell-side (target)

- Approx. $25.4 billion in advisory fees

- Can also advise clients on joint ventures, hostile takeovers, buyouts, and takeover defense.

- Often responsible for performing Due Diligence

- Example of Analyst role in M&A

Back to Career Mapping

Loan Syndication

- Approx. $16 billion in fees

- Investment banks typically acts as lead underwriter (finding buyers or investors).

- Negotiate terms and sell (a portion) to the market (other banks or institutional investors)

- Can be part of DCM group

Back to Career Mapping

Debt (DCM) and Equity Capital Markets (ECM)

- Approx. $16 billion in fees

- Primary role is to assist companies in raising capital: debt or equity (IPO or SEO)

- This is known as the Primary Market

- Key roles: Act as underwriter, set the price, deal with legal and compliance.

Back to Career Mapping

Sales and Trading

- On the public side of the "Ethical wall" (cannot access private info of M&A and Capital Markets)

- Work with buy-side investors to pitch ideas or facilitate trading

- Also known as Markets or Securities division

- Sales: "Owns" relationship with client, split up by product and client class

- Trading: Market makers and execute client trades

- Trading Desk

Back to Career Mapping

Back to Sales and Trading

Sales and Trading

- Starting Analyst Salary: 85k with a 50-80k bonus.

- Career path: Analyst>Associate>VP>Executive Director>Managing Director

- Flat organizational structure (IB is more hierarchical)

More info on Roles, Products, and Trading

Equity Research

- Create a Research Report with a Buy, Sell, or Hold rating.

- Become experts in industry or "coverage universe"

- Usually have constant communication with companies (CEO/CFO)

- Exit opportunities to Buy-side

- More favorable working schedule than IB analyst

- Starting Salary: Similar to IB analyst but smaller bonuses

Back to Career Mapping

Retail and Commercial Banking

- Primary role is to provide loans to individuals/companies

- Help companies deal with cash management

- Typically enter as Credit Analyst (55-90k)

- Credit Analyst>Account Manager>Loan officer

Back to Career Mapping

Buy Side

- Who funds the buy side?

- Individuals ($112T)

- Banks($50.6T)

- Pensions($33.9T)

- Insurance($241T)

- Endowments($1.4T)

- 25% of these assets are outsourced to be managed by buy side firms

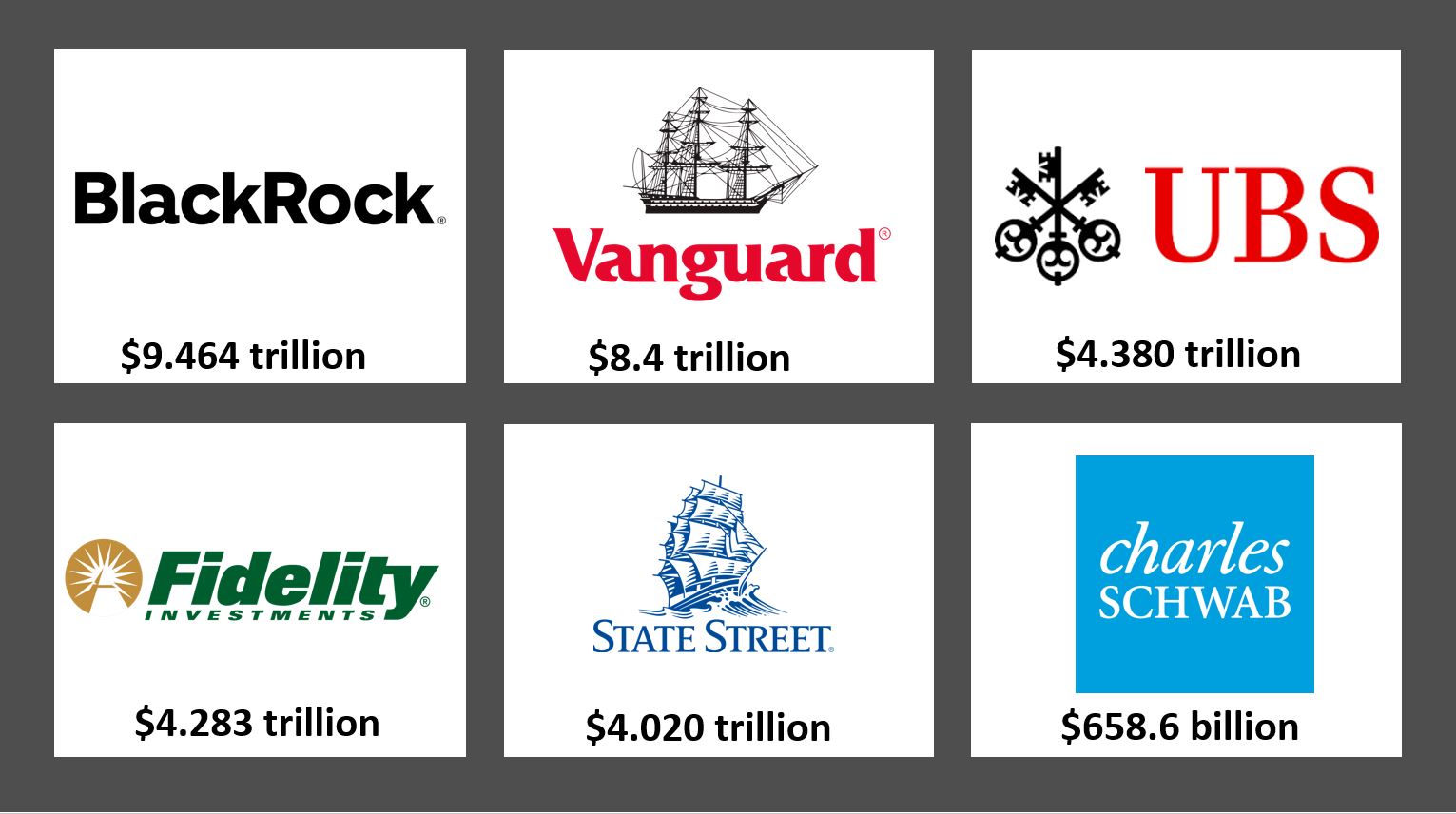

Buy-Side Investment Funds

- Mutual Funds and ETFs ($21 trillion)

- Hedge Funds ($3 trillion)

- Private Equity ($5 trillion) & Venture Capital ($0.5 trillion)

Investment Management Companies

Mutual Funds and ETFs

- Mutual funds can be passive (index) or active

- Active

- Portfolio managers and analysts analyze investment opportunity

- Invest in stocks, bonds, or both

- Goal is to "beat" the market (risk adjusted return)

- ETFs (exchange traded funds) are mostly passive and are actively traded

- Passive funds track a specific index.

Back to Career Mapping

Hedge Funds

- Private funds with restricted investors

- More freedom than Mutual funds, i.e., speculative trading

- Can lock-up investor's money

- High fees: 1.5-2% AUM and 15-20% performance fee

Back to Career Mapping

Private Equity and Venture Capital

- Private Equity (PE)

- Invest in private companies or take public companies private (delisting)

- Can use equity or debt (LBO)

- Typically invest in more mature firms and own 100%

- Often take active role.

- Venture Capital (VC)

- Sub field of PE investing in young/start-up companies.

- Typically invest in less than 50% of company.

- Focus on tech and medical. (Full sector breakdown)

Back to Career Mapping

Buy Side Careers and Salaries

- Portfolio Management (MF): $250k + bonus up to $1M

- Research Analyst: $150k-200k+ & up to 100% bonus

- Private Equity: Similar to IB out of undergrad. More lucrative at the top.

- Venture Capital: Typically earn less than PE

- Hedge funds: $350k + bonus up to $1M

Salary Data

Back to Career Mapping

Corporate Finance

Corporate Finance Jobs

- Multitude of possible positions

- Working in "industry" or for "issuers"

- Amass special knowledge related to industry, e.g., Entertainment

- Common positions: Financial Planning and Analysis, Corporate Development, Treasury, Investor Relations, and many others.

Financial Planning & Analysis

- Skills: Strong modeling and presentation (oral and written). Good understanding of accounting and capital budgeting.

- Careers: Can move up within the company to eventual position in senior management.

- Typical Companies: Any company from Disney to a small private company.

- Starting Salary Range: 50-80k

Back to Career Mapping

Corporate Development (M&A)

- Skills: Similar to Investment Banking M&A

- Career: Typically come from investment banking. Start as analyst and can move up to: Manager>Director>VP>Head of Development>CFO>CEO.

- Typical Companies: Typically larger corporations.

- Starting Salary Range: 80-100k

Back to Career Mapping

Treasury

- Skills: Strong accounting. Presentation and communication important. Detail oriented.

- Career: Typically promoted internally from more accounting based jobs. Start as analyst and can move up to: Manager>Director>VP>Treasurer>CFO.

- Typical Companies: Typically larger corporations.

- Starting Salary Range: 50-80k

Back to Career Mapping

Other Corporate Finance Jobs

- Risk management: manage all types of risks for the company (credit, market, operational, liquidity)

- Investor relation: more of a public relations and advertising role. Maintain relationship with investors.

- Specific analyst positions: Cost, Pricing, Credit, Benefits.

- Real Estate Officer: deal with the evaluation and purchase of real assets.

Back to Career Mapping

Retail Finance Jobs

- Stock broker: work for broker dealer and execute trades. (Changing industry)

- Financial Planner: usually have fiduciary role. Give advice and manage portfolios. (Starting salary: $60K)

- Wealth Management: same role as planners but have high-net worth clients.(Starting salary: $60-75K)

Other Careers in Finance

- Commercial Banking: Can be viewed as part of sell-side. Provide loans to primarily corporations.

- Real Estate: Multiple career paths dealing with transactions of real assets. (think buy-side for real assets)

- Consulting: Sell-side but selling expert analysis and recommendation usually for specific problem.

- Advisory: Similar to consulting but longer-term involvement with client.

- Fin-tech: integration of technology into financial services (robo advisors, P2P lending, payment apps)

Why Internships are Important?

- Gain experience and apply skills/knowledge

- Test out preferred career path

- Good internships will be less than 25% "grunt" work

- Competitive edge

- Try to start summer internships in Freshman or Sophomore Summer.

Getting Internships

LMU Recent Placements

Resources at LMU

Lion Cub Fund

- Open to all LMU students

- Roles

- Analyst: provide potential investment ideas to their group

- Senior Leader: Oversee analyst teams.

- Weekly group meetings will be a combination of learning modules and stock pitches.

Competitions

Student Investment Fund

- Provide in-depth understanding of security analysis, security valuation and selection, and portfolio management and evaluation

- Gain “hands-on” experience by managing an endowed portfolio of equity securities

- Minimum GPA of 3.3 at the time of application

Email Dr. Dennis Draper for more info or to apply.

Wall Street Prep

- Please use @lion.lmu.edu email when signing up.

- Class of 2024

- Class of 2025

- Class of 2026

- Class of 2027

Bloomberg Finance Learning Lab

- Fast access to news, data, unique insight and trading tools.

- Provides coverage of markets, industries, companies & securities across all asset classes.

- Bloomberg Market Concepts Certification

- Bloomberg Course

Post Bachelor Education and Training

Graduate Education

- MBA: Basic business training. Sometimes required to "move up" on the corporate side.

- Ease of admission: Easy to Difficult. Time to complete: 1-2 years. Cost: $$

- MSF: More finance focused. Typically STEM designated. Allows for jobs across the finance industry.

- Ease of admission: Medium to Difficult. Time to complete: 1-2 years. Cost: $$

- Masters of Financial Engineering: More geared towards careers in investment. Very technical, math oriented programs. Typically end up on sell-side.

- Ease of admission: Difficult. Time to complete: One year. Cost: $$

- Law school: Leverage finance undergrad to work in corporate or financial law.

- Ease of admission: Medium to Difficult. Time to complete: 3 years. Cost: $$$

- PhD Finance/Economics: Focuses on research. Typical job is in academics or government (SEC/Fed)

- Ease of admission: Difficult. Time to complete: 5+ years. Cost: $

Certifications

- Certified Financial Analysts (CFA): Top designation. Primarily for Investment Management. 3 Levels. Average Pass Rate: 41%

- Certified Financial Planner (CFP): For financial advisors. 1 exam. Average Pass Rate: 65%

Click here to see more Certifications.

Licenses

- FINRA (Financial Industry Regulatory Authority) oversees all securities licensing.

- Series 6: Sell packaged investment products

- Series 7: Sell virtually any type of individual security. "Stock Brokers".

- Series 3: Sell commodity futures contracts

- NASAA (North American Securities Administration Association)

- Series 63: required by all states (if you carry Series 6 or 7 must have this)

- Series 65: required if providing any type of financial advice or service on non-commission basis. (Investment advisors)

- Series 66: combines 63 and 65 into one exam.

Pass rates are above 70%.