Model Selection and Football Field Chart

Created by David Moore, PhD

Key Concepts

- Absolute(Intrinsic Valuation) vs Relative Valuation

- Pros and Cons

- How and When to use

- Football Field Chart

- Making Investment Decision/Recommendation

Valuation and Financial Modeling

- In a science, if you get the inputs right, you should get the output right. The laws of physics and mathematics are universal and there are no exceptions.

Valuation is not a science. - In an art, there are elements that can be taught but there is also a magic that you either have or you do not. The essence of an art is that you are either a great artist or you are not.

Valuation is not an art. - A craft is a skill that you learn by doing. The more you do it, the better you get at it.

Valuation is a craft.

Intrinsic Valuation

- Estimate cash flows for forecast period

- Estimate Terminal Value

- Estimate Cost of Capital

- Discount Cash flows and terminal value

- Adjust for leverage and divide by appropriate shares outstanding

- Make any adjustments for value included or not included above

Intrinsic Valuation Market Assumption

Valuation Myths

- A valuation is a search for the "true" value

- A good valuation provides a precise estimate of value

- The more quantitative a model, the better the valuation

Valuation Truths

- All valuations are biased. The only questions are "how much" and in which direction.

- There are no precise valuations. The payoff to valuation is greatest when valuation is least precise.

- One's understanding of a valuation model is inversely proportional to the number of inputs required for the model. Simpler valuation models do much better than complex ones.

Intrinsic Valuation Pros

- Very little influence from temperamental market conditions (Market Moods and Perception)

- Measure of what you are getting in return (for buying an asset)

- Focuses on underlying characteristics

- Forces you to think about the business and assumptions

- Eventually you will get cash flows (immunized from market perception)

Intrinsic Valuation Cons

- Requires far more inputs and information

- Present value is sensitive to key assumptions

- Inputs and assumptions are noisy and can easily be manipulated (Biases!)

- No guarantee any asset will be undervalued or overvalued

- Who is this a problem for?

Intrinsic Valuation Value Drivers

- Cash flows from existing assets

- Value added by growth of assets

- Risk of cash flows from both existing assets and growth

- When will the firm become a mature firm

When to use DCF

- Best for investors with long-term horizon, ability to move price, not swayed by market

- Easier for stable, predictable firms. Bigger payoff in the "dark"

Relative Valuation

- Identify comparables and get market values

- Standardize market value (create multiples)

- Compare standardize value to firm (or use to calculate implied price of firm)

Relative Valuation Market Assumption

Relative Valuation Pros

- Reflects market perception and moods.

- Will always have overvalued and undervalued assets

- Helps if performance is relative

- Fewer assumptions and inputs (explicit)

- Easy to implement

Relative Valuation Cons

- Undervalued can still be overvalued (just less so)

- Fails if markets can be over/under valued in the aggregate

- Still making implicit assumptions (value drivers)

- Hard to find true comparables

Relative Valuation Value Drivers

- Similar to DCF (cash flows, growth, risk)

- Making very similar implicit assumptions

When to use Multiples

- Large set of potential comparables that are priced with available common variable

- Best for investors with short-term horizon (incremental game), judged on relative benchmark.

- Can take advantage of both sides (buy undervalued, sell(short) overvalued i.e., hedge fund

Pricing

- Mood and momentum (including behavioral factors)

- Incremental information and deviation from expectation (news, rumors, gossip)

- Liquidity (Ease of trading)

- Group think

Gap between Price and Your Value

- Efficient Marketer: gap is random buy low cost index funds

- Value Extremist: Eventually price moves to value therefore buy and hold undervalued stocks

- Pricing Extremist: Price may never converge to value, no such thing as intrinsic value. Look for market mispricing and get ahead of shifts in momentum

Pricer Dilemma

- No anchor

- Reactive

- Must be able to read the crowd/mood and detect shifts to move early

Valuer Dilemma

- Uncertainty about magnitude of gap

- Uncertainty about the gap closing

- Karmic vs Catalyst approach

What now? Relative or Absolute

- Two different questions: Price vs Value

- Under certain scenarios can get similar answers

- Buying an asset:

- What are you giving up(Price)

- What are you getting in return(Value)

- Personal investment philosophy/strategy dictates approach

- Can be used as complements

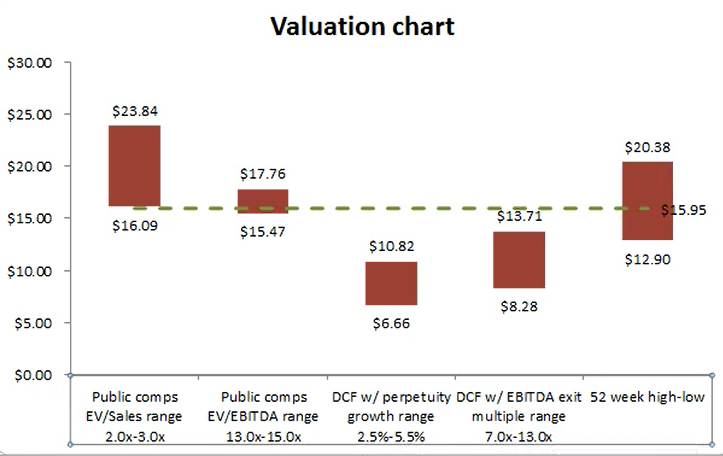

- Common to use results from both methods to produce a range

Football Field Chart

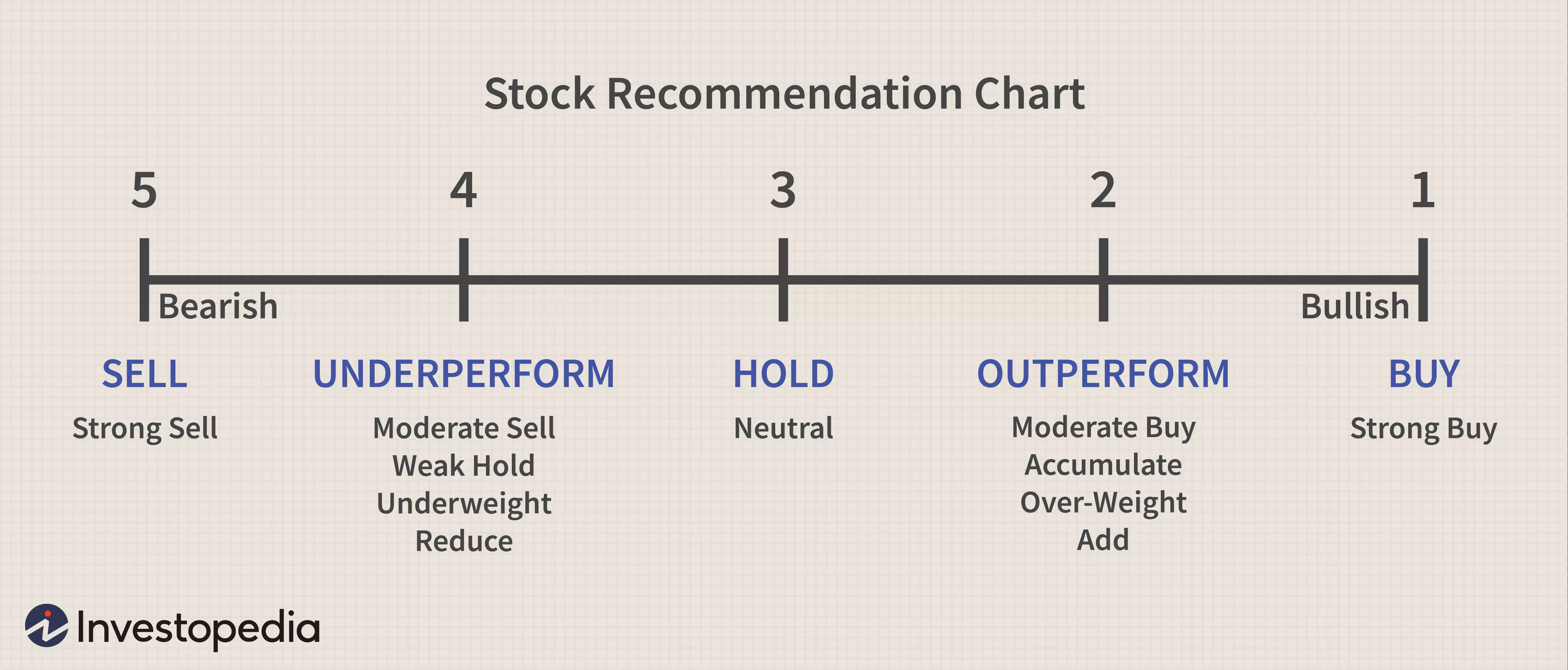

Making Investment Recommendation

Example: Apple Example: Silk Road Medical

Next time

Advanced Excel