Interest Rates and Bond Valuation

Created by David Moore, PhD

Reference Material: Chapter 7 of TextbookKey Concepts

- Bond valuation (pricing a bond)

- Bond terms and features

- Inflation and Interest rates (Real vs Nominal)

- Term Structure of interest rates

Intro to Bonds

Key terms:

- Par Value (face value):principal repaid, usually $\$$1,000 per bond;

- Discount bond: price $<$ Face Value

- Premium Bond: price $>$ Face Value

- Coupon rate: annual interest rate

- Coupon payment: stated interest payment

- Maturity date: specified date on which principal (face value) is repaid

- Yield to Maturity (YTM): market interest (required return) on a bond. OR the rate implied by the current bond price.

Bond Valuation

Bond Valuation

Good News! This is just a TVM problem.Bond Value=PV of Coupons + PV of Face Value

N= Time to Maturity

Rate(I%)= Yield to maturity

Present Value(PV)= Price

Payment(PMT)= Coupon payment= coupon rate*face value

Future Value (FV)= Face value or par value

Example 1

Suppose you are reviewing a bond that has a 10% annual coupon and a face value of $\$$1,000. There are 20 years to maturity, and the yield to maturity is 8%. What is the price of this bond? Why do we call it a premium bond?N= 20

Rate(I%)= 8

Present Value(PV)= -1196.36

Payment(PMT)= 1000*.10=100

Future Value (FV)= 1000

Try solving using PV formulas.

Example 2 - Your Turn

Suppose you are reviewing a bond that has a 10% annual coupon and a face value of $\$$1,000. There are 20 years to maturity, and the yield to maturity is 12%. What is the price of this bond? Why do we call it a discount bond?Example 3 Semi-Annual coupons

Suppose a bond with a 10% coupon rate and semiannual coupons, has a face value of $\$$1,000, 20 years to maturity and is selling for $\$$1,197.93. What is the YTM?N= 20x2=40

Rate(I%)= 3.99 x 2 = 8

Present Value(PV)= -1197.93

Payment(PMT)= (1000*.10)/2=50

Future Value (FV)= 1000

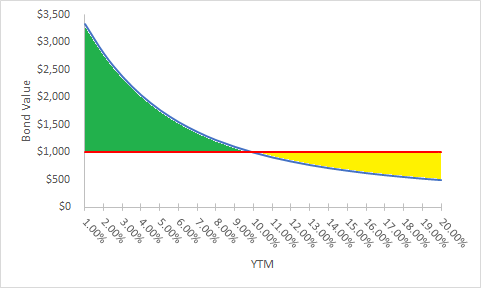

Bond Prices and Interest Rates

Green: YTM$<$Coupon Bond is trading at a ?

Yellow: YTM$>$ Coupon Bond is trading at a ?

Intersection: YTM=Coupon Bond is trading at ?

Interest Rate Risk

All else equal..

- the longer the time to maturity, the greater the interest rate risk.

- the lower the coupon rate, the greater the interest rate risk.

Current Yield vs YTM

$YTM=Current Yield + Capital Gains Yield$, where:$Current Yield=\frac{Annual Coupon Pmt}{Price}$

$Capital Gains Yield= \frac{P_1-P_0}{P_0}$

Current Yield Example

Consider a 10% coupon bond with semi-annual coupons, face value of 1,000, and 20 years to maturity is selling for $\$$1,197.93. What is the Current Yield, Capital Gains Yield, Yield to Maturity?Bond Terms and Features

The Players

- The person or firm making the loan is called the creditor or lender.

- The person or firm borrowing the money is called the debtor or borrower.

The money being lent(borrowed) is called a debt security.

Debt vs Equity

- Debt is an NOT an ownership interest. (Creditors have no voting power)

- Payment of interest is considered “cost of doing business” and is thus tax deductible. (Dividends are not)

- Unpaid debt is a liability to the firm. Therefore cost of issuing debt is financial failure(bankruptcy) causing liquidation or reorganization. Equity is not a liability.

Fun fact: Firms try really hard to make/create securities that have features of equity but are treated like debt.

Long-Term Debt

- One-year typically distinction between short-term and long-term

- Debt securities typically called notes, debentures, or bonds.

- Typically issue maturities with $<10$ years= Note and $>10$years=Bonds

- Two types of forms: Public Issue and Privately placed.

- We focus on public issue

- Terms of privately placed long term debt determined by the parties involved.

The Indenture

- Trustee represents bondholders and must:

- Ensure terms are obeyed

- Manage sinking fund (described later)

- Represent bondholder in default

- This is a legal document

- Generally includes: Basic terms of the bond, total amount of bonds issued, description of property used as security(collateral), repayment arrangements, call provisions, protective covenants.

Apple Example

Bond Forms

- Registered form: Registrar of the company records ownership of each bond; payment is made directly to the owner of record.

- Example: Interest is payable semiannually on July 1 and January 1 of each year to the person in whose name the bond is registered at the close of business on June 15 or December 15, respectively.

- Bearer form: The bond is issued without record of the owner's name; payment is made to whomever holds the bond.

Bearer Form Example

Security

- Collateral: securities that are pledged as security for payment of debt. (Commonly used to refer to asset pledges on a debt.)

- Mortgage security: Secured by a mortgage on a real property of the borrower(your house).

- Legal document describing mortgage is called Mortgage trust indenture or trust deed

- Blanket mortgage: pledges ALL the real property owned by the company. (Land and fixtures not cash and inventories)

Debenture

- Referred to as Note if original maturity is less than 10 years.

- Only claim is on property not otherwise pledged.

Seniority

- Labeled as senior or junior

- Subordinated: paid off only after specified creditors have been compensated.

Note: Debt CANNOT be subordinated to equity.

Repayment

- Bonds can be repaid:

- At maturity

- Repaid in part or in entirety before maturity

- Sinking fund: Account managed by the bond trustee for the purpose of repaying the bonds.

- Firm makes annual payments to the trustee, who then uses funds to retire portion of the debt

- Arrangements for repayment come in many different forms.

Call provision

- Corporate bonds typically callable

- Call premium: Difference between call price and stated value (par value)

- Deferred call provision: Prohibiting the company from redeeming a bond prior to a certain date.

- Call protected bond: A bond that, during a certain period, cannot be redeemed by the issuer.

Protective Covenants

- Usually to protect investors

- Two types: Positive covenants (thou shalt) and negative covenants (thou shalt not).

- Ex. Negative: limit dividends, cannot pledge assets to other lender, cannot do a merger, cannot sell or lease major assets without approval, cannot issue additional long term debt

- Ex. Positive: Must maintain certain level of working capital, furnish audited financial statements, maintain securities.

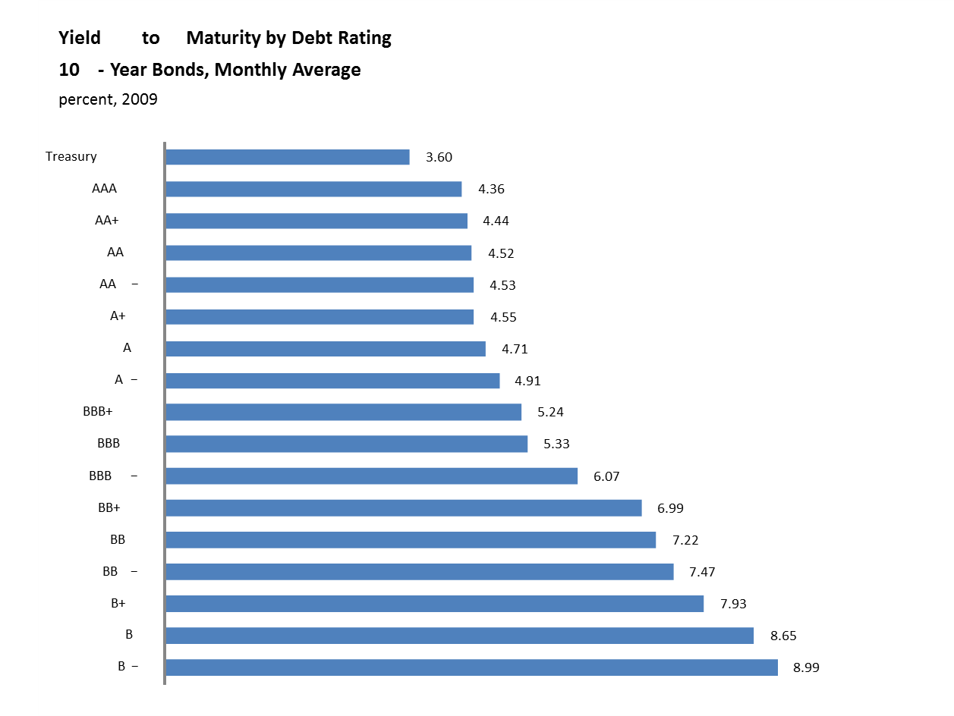

Bond Ratings

- Debt rating:

Assessment of the creditworthiness of the corporate issuer. - Based on how likely the firm is to default and protection creditors have in the event of default

- Rated by Standard & Poor's (S&P) and Moody's

- High grade is AAA(Aaa) (fairly rare)

- AA(Aa) much more common, very good quality debt(i.e. low risk)

- Investment-Quality grade: High: AAA, AA Medium: A, BBB

- Speculative (Junk) grade: BB, B, CCC, CC, (Very low grade:C, D)

Bond Types

Government

- US government is biggest borrower in the world

- Currently 21.5 Trillion (about 65,441 per citizen or 176,475 per taxpayer)

- Government debt known as Treasury Bill($<$ 1 year), Note(1-10 years) or Bond($>$10 years)

- No default risk: assume US gov't will pay its debts

- Exempt from state taxes (only pay federal)

Municipal (Munis)

- These do have default risk

- Coupons are exempt from FEDERAL income tax

Example: Taxable US treasury bond vs Tax Exempt Muni

| Bond Type | Pre-tax return | After-tax return |

|---|---|---|

| Taxable Bond | 8% | 8%(1-.40)=4.8% |

| Muni Bond | 6% | 6% |

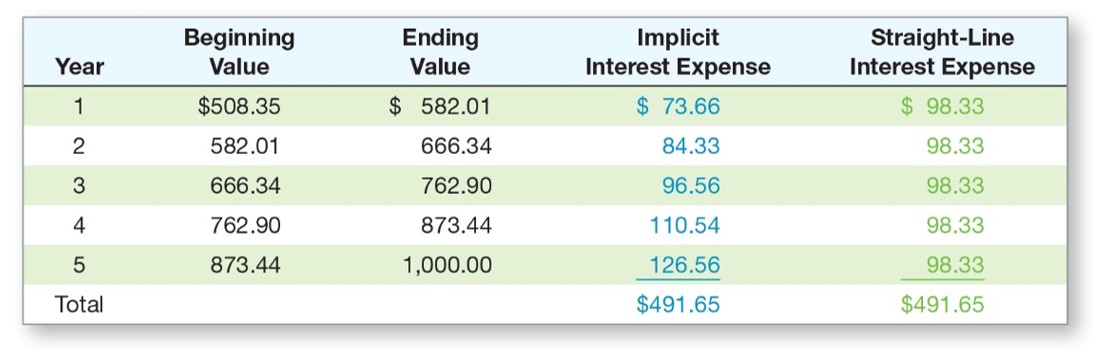

Zero coupon bonds (zeroes)

Floating rate bonds (floaters)

- Coupon rates are adjustable (tied to an interest rate index)

- Most floaters have the following:

- Put provision: Holder has the right to redeem the note at par on the coupon payment date after some specified amount of time

- Collar: Coupon rate has a floor and a ceiling. Coupon rate is "capped"

- Example: Inflation linked bond: coupons adjusted according to rate of inflation ex. TIPS (Treasury Inflation Protected Securities)

Other Types/features

Note: a bond can have many features (only limited by imagination of parties involved.)

- Warrant: gives the buyer of the bond the right to purchase shares of stock in the company at a fixed price

- Income bonds: coupon depends on income of corporation

- Convertible bond: can be swapped for a fixed number of shares

- Put bond: allows holder to force issuer to buy back the bond at a stated price.

- Structured notes: bonds based on stocks, bonds, commodities, or currencies, Ex. Based off stock index.

Mortgage Backed Securities

The Bond Market

Overview

Treasury Quotations

| Maturity | Coupon | Bid | Asked | Chg | Asked Yield |

|---|---|---|---|---|---|

| 2/15/2019 | 8.875 | 102.3594 | 102.3750 | -0.0156 | 2.322 |

- What is the coupon rate on the bond?

- When does the bond mature?

- What is the bid price? (The price the dealer is willing to pay)

- What is the ask price? (The price the dealer is willing to take)

- How much did the price change from the previous day?

- What is the yield based on the ask price?

Inflation and Interest Rates

Real vs Nominal rates

- Nominal: Have not been adjusted for inflation

- Real: Have been adjusted for inflation

- Nominal: percentage change in the number of dollars you have

- Real rate: Percentage change in how much you could buy with your dollars. (percentage change in buying power.)

Fisher effect

The relationship between nominal returns, real returns, and inflation.$1 + R = (1 + r) x (1 + h)$, where:

R=Nominal rate

r=Real rate

h=inflation rate

Example

If we require a 10% real return and we expect inflation to be 8%, what is the nominal rate?Example with PV

Want to withdraw $\$$25,000 worth of purchasing power each year for next 3 years. Inflation rate is 4%. Nominal rate is 10% . What is the present value? (HINT: use nominal cash flows and nominal rate or real cash flows and real rate)Term Structure of Interest Rates

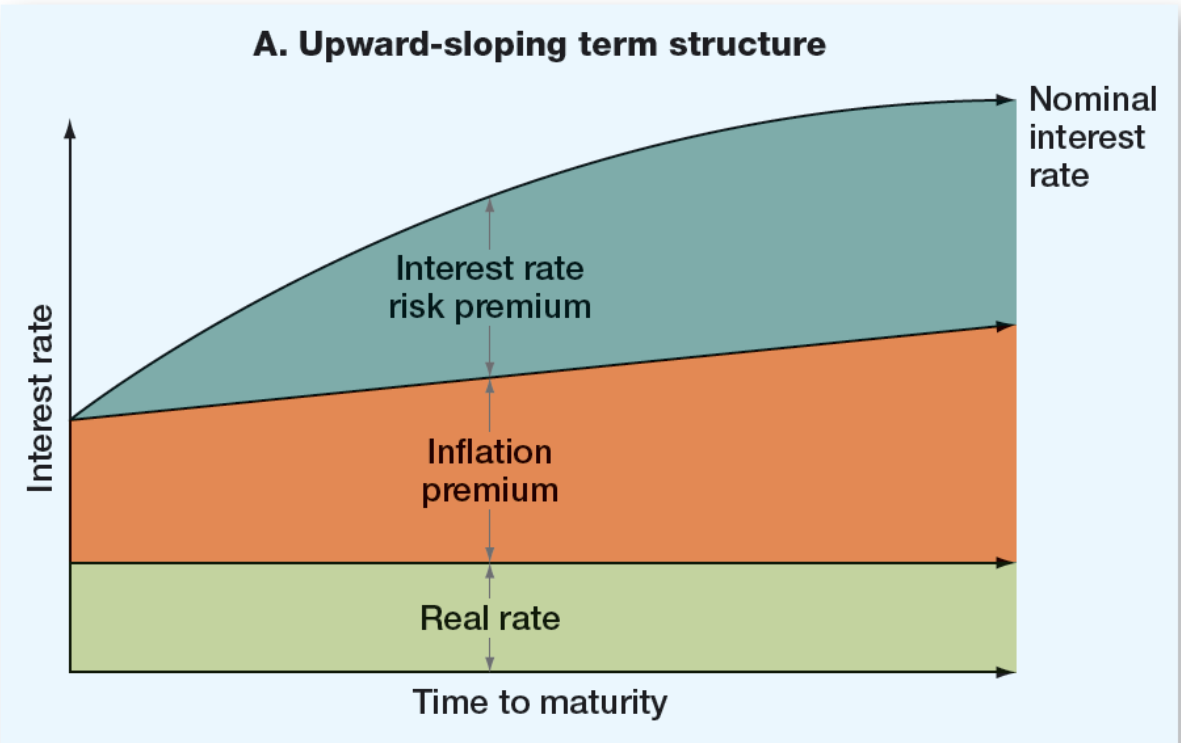

What is term structure?

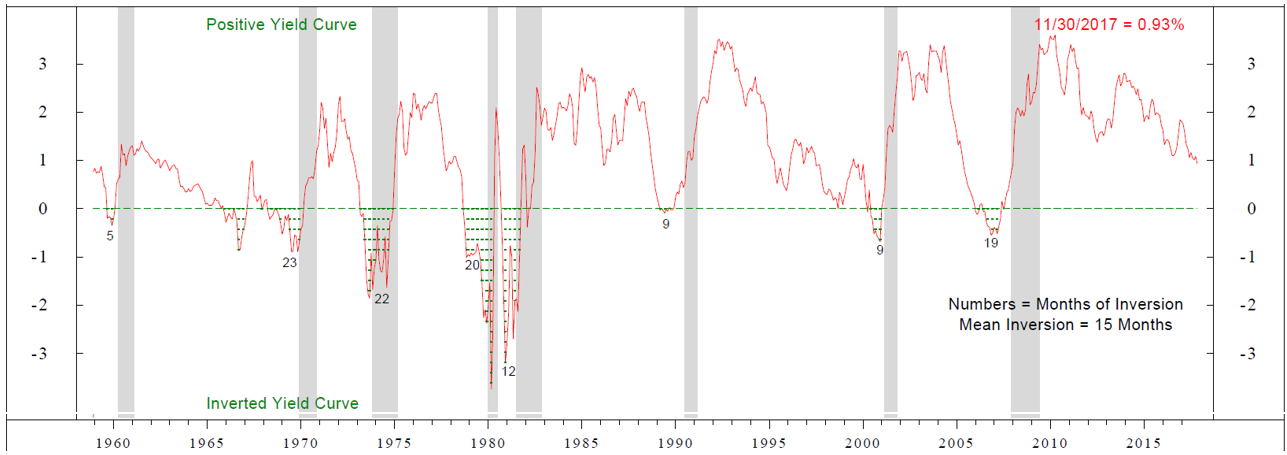

- Upward sloping(normal): long-term rates are higher than short term rates (most common)

- Downward sloping(inverted): Short-term rates are higher than long term rates.

Upward Sloping

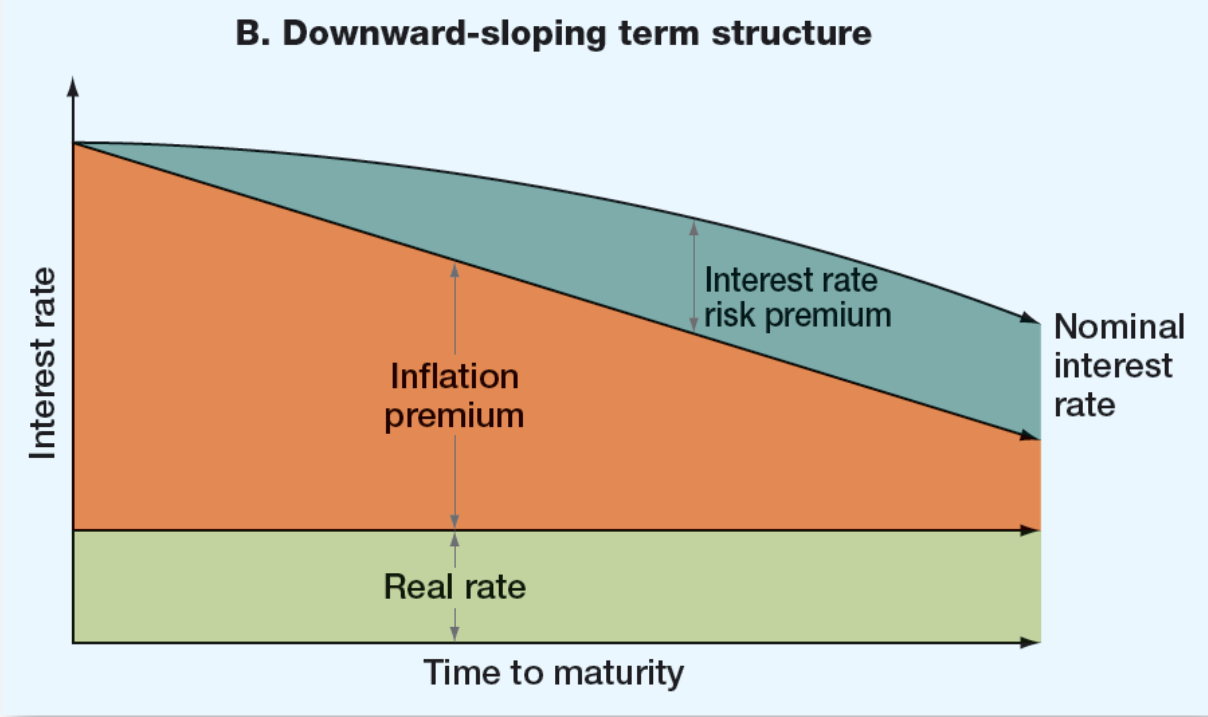

Downward Sloping

Term Structure Components

- Real rate: the compensation for investors foregoing use of money.

- Inflation Premium: compensation for loss in value of a dollar.

- Interest rate risk premium: compensation for risk of changing interest rates. (increasing at a decreasing rate)

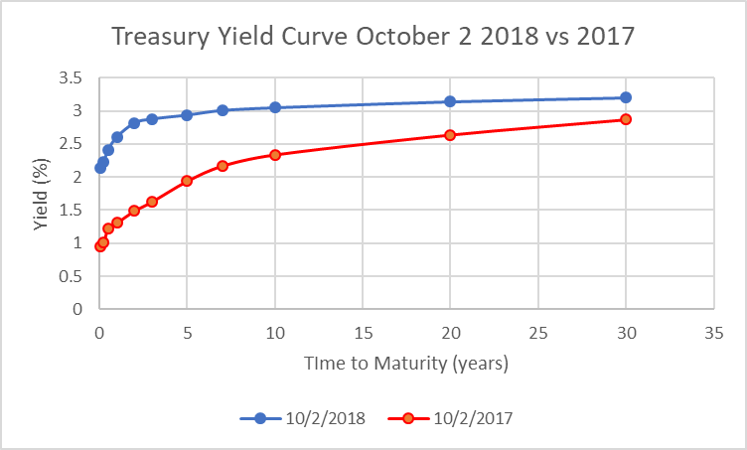

Treasury Yield Curve

- Based on coupon bond yields (Only difference to term structure)

- Three components: Real rate, expected future inflation, interest rate risk premium.

- Three key features: Default free, taxable, highly liquid.

Yield Curve and Recessions

What about other factors?

- Default risk premium(credit risk): compensation for possibility of default. Demand a higher yield as risk won't receive promised payments.

- Fun fact: "Junk" bonds are called high-yield (Marketing tactic) but really its high promised yield.

- Taxability premium: compensation for unfavorable tax treatment.

- Liquidity premium: compensation for lack of liquidity (some bonds are easily tradeable without losing value)

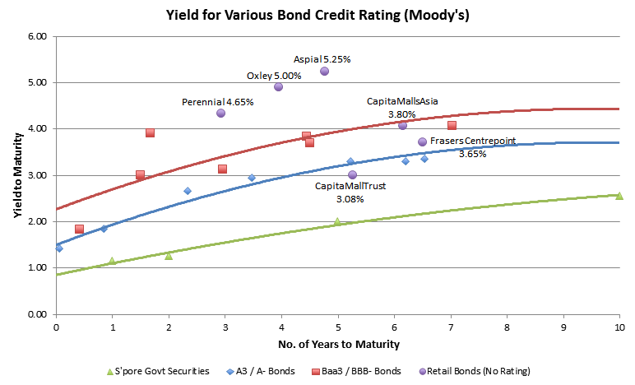

Default Premiums and YTM

Yield for Different Bond Ratings

Key Learning Outcomes

- Bond valuation: price, YTM, coupon payment, face value, time to maturity

- Bond terms

- Bond ratings

- Bond types

- Bond market

- Inflation and interest rates

- Term structure