Net Present Value and Other Investment Criteria

Chapter 9

Created by David Moore, PhD

Key Concepts

- Net Present Value (NPV)

- Payback Period

- Internal Rate of Return (IRR)

- Investment criteria (accept/reject decision)

- Mutually Exclusive Projects and Non-conventional cash flows

Capital Budgeting

Personal Capital Budgeting Examples

- Graduate School

- How expensive is grad school?

- How long will it take?

- How much more will I make with a grad degree?

- What are the opportunity costs of wages while in grad school?

- Repair or Replace Car

- How expensive is new car?

- How much are my expected repair bills going to be with the old car?

- How long before the old car is inoperable?

Capital Budgeting Tesla Example

Example: College cash flows

- Average costs to attend a 4 year public university in the U.S. have risen from about $\$$27,161 in 1996 to about $\$$39,529 in 2016.

- As of 2018, the average annual earnings for a high school graduate were $\$$35,256. The average starting annual earnings for a college graduate with a business degree were $\$$62,000. For simplicity, let's ignore taxes and just assume these are all after-tax cash flows.

- Assume that you complete the degree in 4 years. You work for 45 years after attaining your degree and college salary grows at 3% annually. All cash flows occur at the end of the period (e.g. no outflows at t=0).

We will come back to this and use investment criteria to make decision.

Key points

- Analysis of potential projects

- Fixed Asset

- New product

- Enter new market

- Long-term decisions

- Large expenditures

- Difficult/impossible to reverse

- Determines firm's strategic direction

Decision Criteria

Good Decision Criteria

- All cash flows considered?

- TVM considered?

- Risk-adjusted?

- Ability to rank projects?

- Indicates added value to the firm?

Tools

- Net Present Value (NPV)

- Payback Period

- Internal Rate of Return

Sample Project

You are looking at a new project and have estimated the following cash flows, net income and book value data:

| Year | Cash Flow |

|---|---|

| 0 | -165,000 |

| 1 | 63,120 |

| 2 | 70,800 |

| 3 | 91,080 |

This project will be the example for all problem exhibits in this chapter.

Net Present Value

Overview

- Estimate the expected future cash flows.

- Estimate the required return for projects of this risk level.

- Find the present value of the cash flows and subtract the initial investment to arrive at the Net Present Value.

Calculation

$$NPV=\sum_{t=0}^n \frac{CF_t}{(1+r)^t}$$

Initial cost is often $CF_0$ and is an outflow.

$$NPV=\sum_{t=1}^n \frac{CF_t}{(1+r)^t}-CF_0$$

Decision Rule

- What does a positive NPV mean?

- Project is expected to add value to the firm

- Will increase the wealth of the owners

- NPV is a direct measure of how well this project will meet the goal of increasing shareholder wealth.

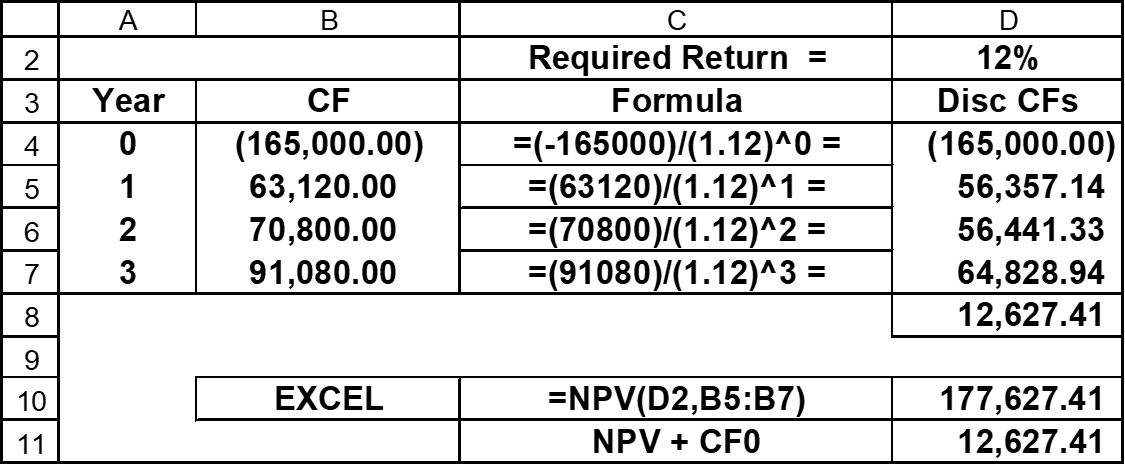

NPV for Sample Project

$$NPV=\sum_{t=0}^n \frac{CF_t}{(1+r)^t}$$| Year | Cash Flow | Formula | Discounted CF |

|---|---|---|---|

| 0 | -165,000 | =(-165000)/1.12^0 | -165,000.00 |

| 1 | 63,120 | =(63120)/1.12^1 | 56,357.14 |

| 2 | 70,800 | =(70800)/1.12^2 | 56,441.33 |

| 3 | 91,080 | =(91080)/1.12^3 | 64,828.94 |

| NPV = | 12,627.41 |

Calculator

- Go to APPS, Finance, 7:npv(

- Function npv(rate, $CF_0$,$CF_1-CF_t$)

- First parameter = required return entered as a percentage

- Second parameter = Cash flow at time 0 (enter as negative if outflow)

- Third parameter=Cash flows from time 1 on: enter using List function

Lists on Calculator

- Enter {

- Enter Cash flows separated by,

- Enter }

- Hit STO$\Rightarrow$

- Hit L1

Excel

- First parameter = required return entered as a decimal

- Second parameter = range of cash flows beginning with year 1

- After computing NPV, subtract the initial investment ($CF_0$)

Rationale

- NPV = PV inflows – Cost

- NPV=0 → Project's inflows are "exactly sufficient to repay the invested capital and provide the required rate of return"

- NPV = net gain in shareholder wealth

Decision Rule

Pros and Cons

- Pros

- Meets all desirable criteria

- Considers all Cash Flows

- Considers Time Value of Money

- Adjusts for risk

- Can rank mutually exclusive projects

- Directly related to firm value

Dominant method; always prevails - Cons

- relies heavily on correct discount rate

Payback Period

Overview

Computation

- Estimate cash flows

- Subtract the future cash flows from the initial cost until initial investment is recovered

- A "break-even" type measure

Computing Payback

| Year | Cash Flow | Cumulative Cash Flows |

|---|---|---|

| 0 | -165,000 | -165000 |

| 1 | 63,120 | -101,880 |

| 2 | 70,800 | -31,080 |

| 3 | 91,080 | 60,000 |

| Payback = | 2 + 31080/91080 | 2.34 years |

Payback = 2 + $\frac{31080}{91080}$=2.34 years

Do we accept or reject the project?

Decision Rule

Pros and Cons

Advantages

- Easy to understand

- Adjusts for uncertainty of later cash flows

- Biased towards liquidity

- Good for small projects (<$\$$10000)

Disadvantages

- Ignores the time value of money

- Requires an arbitrary cutoff point

- Ignores cash flows beyond the cutoff date

- Biased against long-term projects, such as research and development

Internal Rate of Return (IRR)

Overview

- Most important alternative to NPV

- Widely used in practice

- Intuitively appealing

- Based entirely on the estimated cash flows

- Independent of interest rates

Definition

Enter NPV = 0, solve for IRR:

$$NPV=\sum_{t=0}^n \frac{CF_t}{(1+r)^t}$$

Computing IRR

- Without a financial calculator or Excel, this becomes a trial-and-error process

- Calculator

- Make list of the cash flows as for NPV

- Use IRR(CFO,L1)

- IRR is found in Finance, option 8

Decision Criteria

Example

| Year | Cash Flow |

|---|---|

| 0 | -165,000 |

| 1 | 63,120 |

| 2 | 70,800 |

| 3 | 91,080 |

| =IRR($CF_0:CF_3$) | 16.13% |

Accept or Reject?

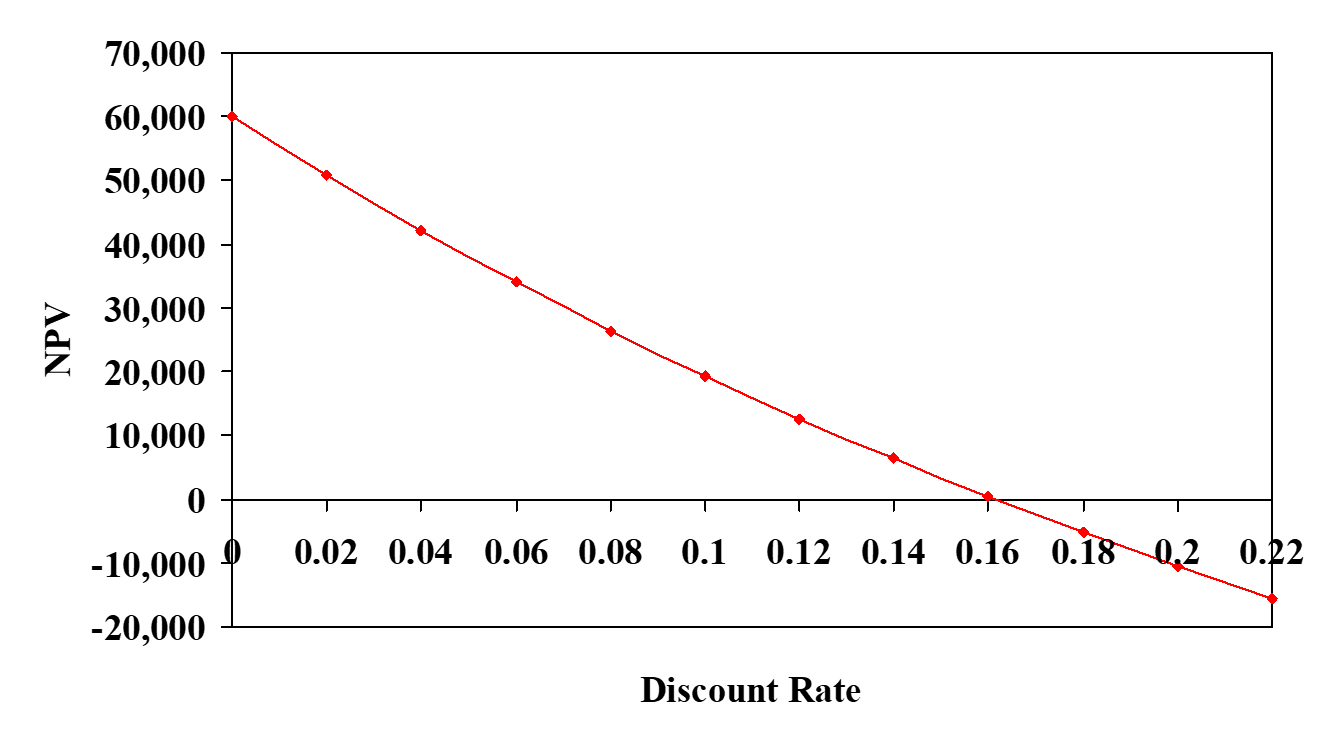

NPV Profile

Pros and Cons

Advantages

- Intuitively appealing/Easy to communicate the value of a project

- If the IRR is high enough, may not need to estimate a required return

- Considers all cash flows

- Considers time value of money

- Provides indication of risk

Disadvantages

- Can produce multiple answers

- Cannot rank mutually exclusive projects

- Reinvestment assumption flawed

Summary of Decisions

| Method | Criteria | Number | Decision |

|---|---|---|---|

| NPV | NPV$>$0 | 12,627.41 | Accept |

| Payback | Unknown | 2.34 years | ??? |

| IRR | IRR$>$Required Return | 16.13% | Accept |

NPV vs IRR: Issues

Overview

- NPV and IRR will generally give the same decision

- Exceptions

- Non-conventional cash flows

- Cash flow sign changes more than once

- Mutually exclusive projects

- Initial investments are substantially different

- Timing of cash flows is substantially different

- Will not reliably rank projects

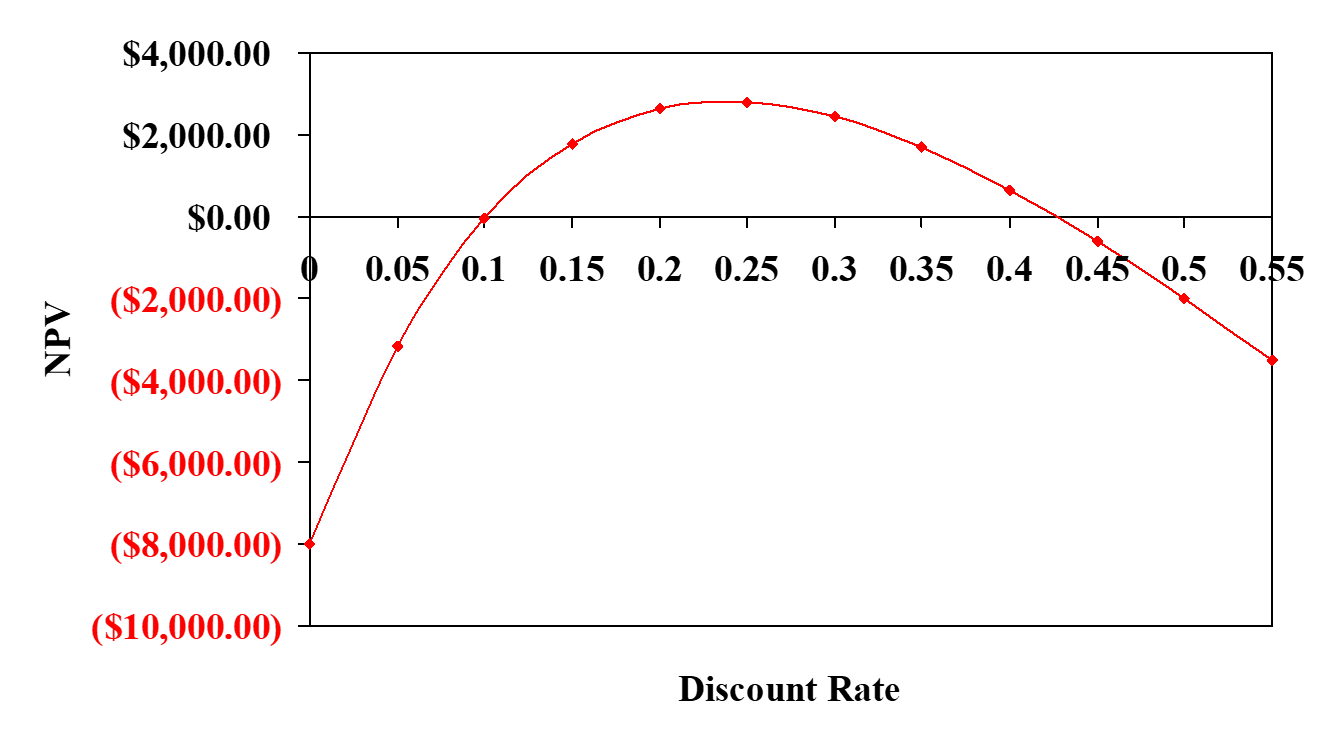

Non-Conventional Cash Flows

- Produces more than one IRR

- Which one do you use to make your decision?

Example

Suppose an investment will cost $\$$90,000 initially and will generate the following cash flows:- Year 1: 132,000

- Year 2: 100,000

- Year 3: -150,000

The required return is 15%.

Should we accept or reject the project?

Summary

| Year | Cash Flow |

|---|---|

| 0 | -90,000 |

| 1 | 132,000 |

| 2 | 100000 |

| 3 | -150000 |

| Investment Criteria | |

|---|---|

| NPV | 1,769.54 |

| IRR-1 | 10.11% |

| IRR-2 | 42.66% |

NPV Profile

When you cross the x-axis more than once, there will be more than one return that solves the equation

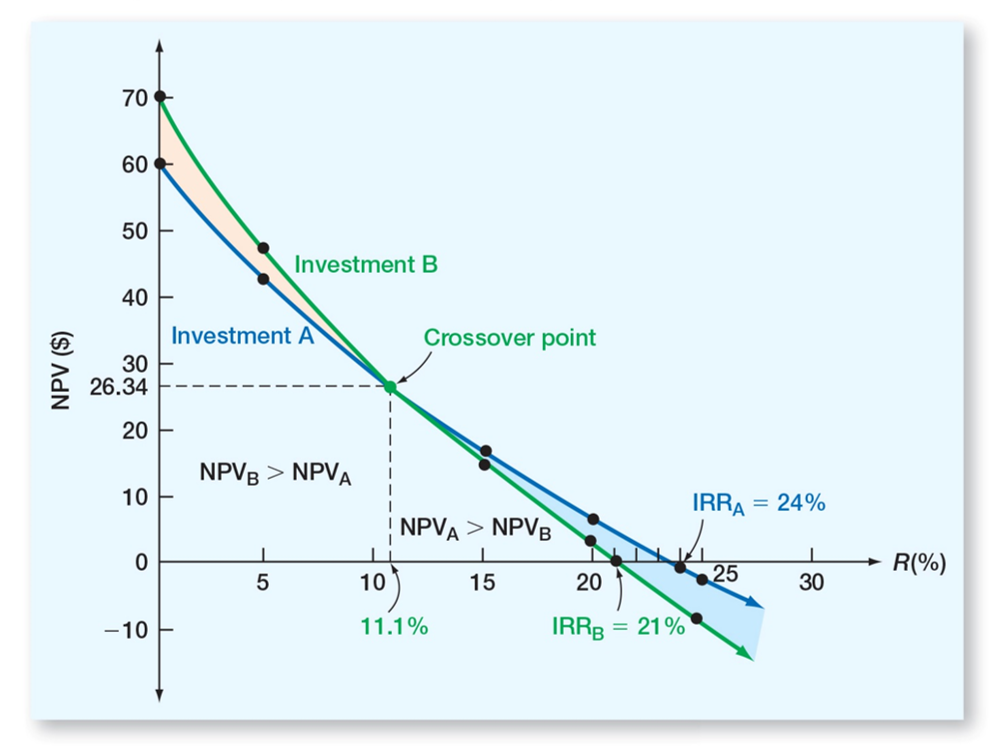

Independent versus Mutually Exclusive Projects

- Independent

- The cash flows of one project are unaffected by the acceptance of the other.

- Mutually Exclusive

- The acceptance of one project precludes accepting the other.

Reinvestment Rate Assumption

- IRR assumes reinvestment at IRR

- NPV assumes reinvestment at the firm's weighted average cost of capital (opportunity cost of capital)

- More realistic/better method

- NPV should be used to choose between mutually exclusive projects

Example

Which project should you accept if the required return is 10% and the you can only finance one project.| Period | Project A | Project B |

|---|---|---|

| 0 | -500 | -400 |

| 1 | 325 | 325 |

| 2 | 325 | 200 |

| IRR | 19.43% | 22.17% |

| NPV | 64.05 | 60.74 |

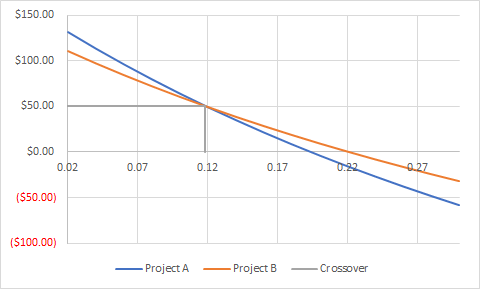

Graph: Crossover Rate

Finding Crossover Rate

| Period | Project A | Project B | Difference |

|---|---|---|---|

| 0 | -500 | -400 | -100 |

| 1 | 325 | 325 | 0 |

| 2 | 325 | 200 | 125 |

| IRR | 19.43% | 22.17% | 11.80% |

Crossover Rate Graph Example 2

Conflicts Between NPV and IRR

- NPV directly measures the increase in value to the firm

- Whenever there is a conflict between NPV and another decision rule, always use NPV

- IRR is unreliable in the following situations:

- Non-conventional cash flows

- Mutually exclusive projects

Other capital budgeting tools

(we will ignore these, know that they exist)- Modified Internal Rate of Return (MIRR)

- Average Accounting Return

- Discounted Payback

- Profitability Index

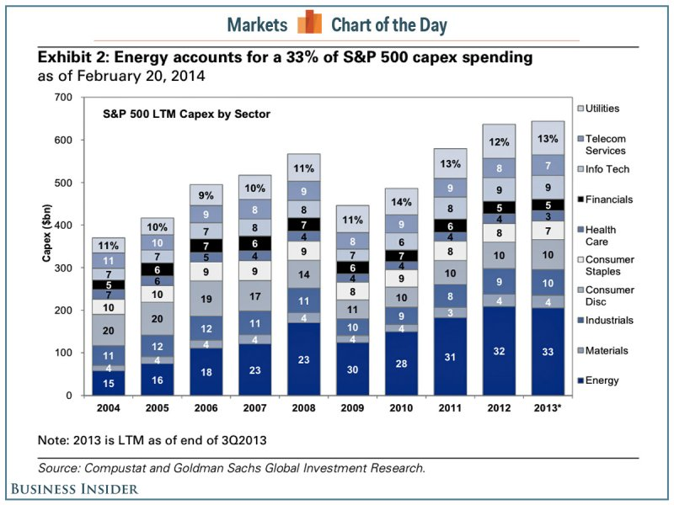

Real World

Capital budgeting importance

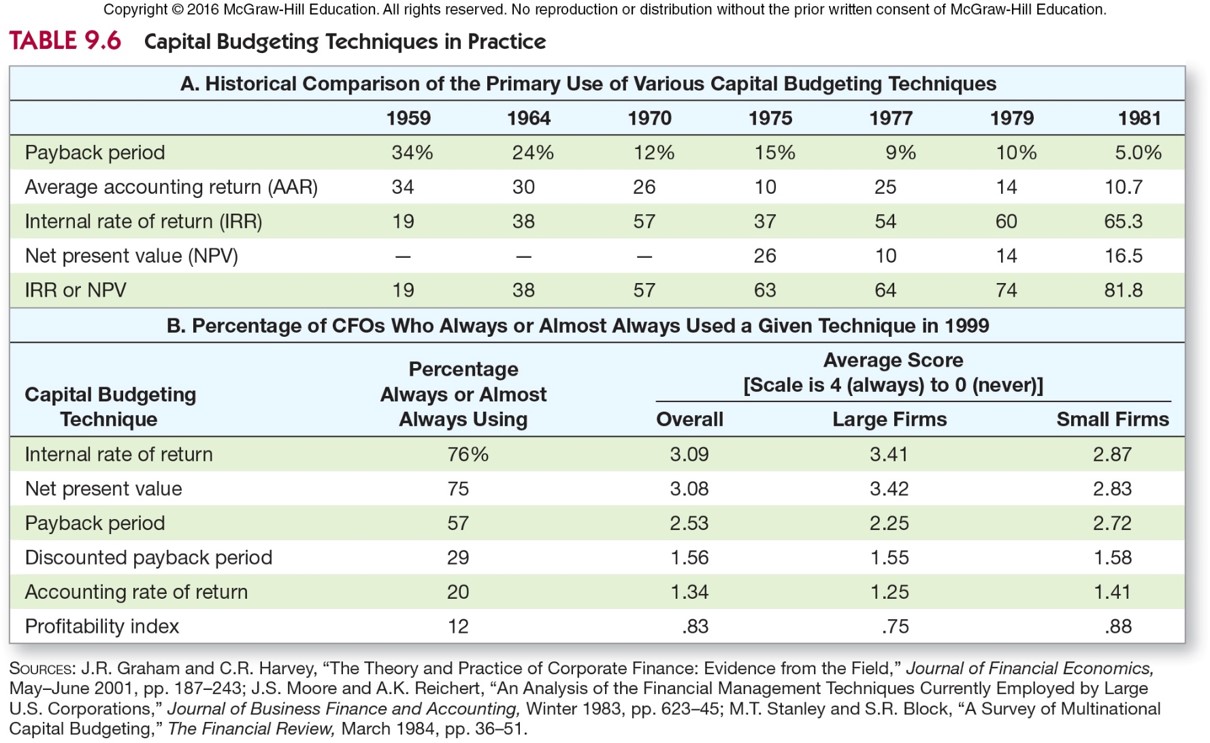

What Do Manager's Do?

Why is IRR popular?

- People like rates instead of dollars.

- "Remodeling the clerical wing has a 20% return"

- "At a 10% discount rate, the net present value is $\$$4,000."

Summary

- Consider all investment criteria when making decisions

- NPV and IRR are the most commonly used primary investment criteria

- Payback is a commonly used secondary investment criteria

- All provide valuable information

Tools Summary

NPV

- NPV= Difference between market value (PV of inflows) and cost

- Accept if $NPV>0$

- No serious flaws

- Does require an appropriate discount rate

- Preferred decision criterion

Payback

- Payback = Length of time until initial investment is recovered

- Accept if payback $<$ some specified target

- Doesn't account for time value of money

- Ignores cash flows after payback

- Arbitrary cutoff period

- Asks the wrong question

IRR

- IRR = Discount rate that makes NPV = 0

- Accept if IRR > required return

- Same decision as NPV with conventional cash flows

- Does not require a discount rate

- Unreliable with:

- Non-conventional cash flows

- Mutually exclusive projects

- MIRR = better alternative (NOT COVERED)

Practice

Example 1

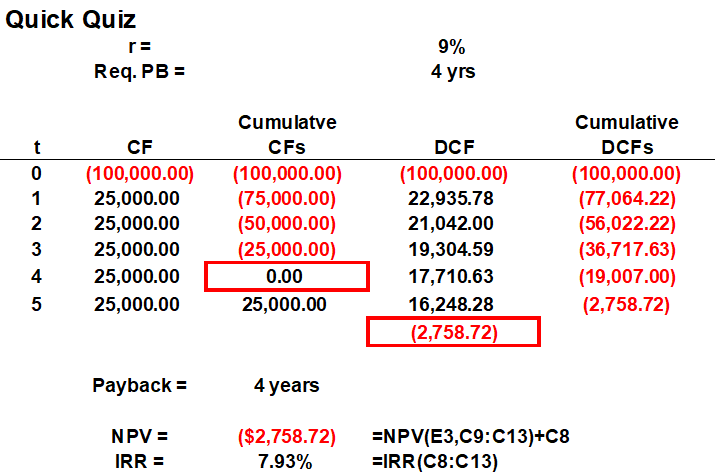

Consider an investment that costs $\$$100,000 and has a cash inflow of $\$$25,000 every year for 5 years. The required return is 9% and required payback is 4 years.- What is the payback period?

- What is the NPV?

- What is the IRR?

- Should we accept the project?

- What decision rule should be the primary decision method?

- When is the IRR rule unreliable?

Solution

Example 2

Benny's is considering adding a new product to its lineup. This product is expected to generate sales for four years after which time the product will be discontinued. What is the project's net present value if the firm wants to earn a 14 percent rate of return?| Year | Cash Flow |

|---|---|

| 0 | -65,000 |

| 1 | 16,500 |

| 2 | 23,800 |

| 3 | 27,100 |

| 4 | 23,300 |

What is the payback?

Revisit College Decision

Car Lease vs Buy Example

Key Learning Outcomes

- Calculate: NPV, Payback Period, IRR

- Make Capital budgeting decision (Decision rule: accept/reject)

- Pros and cons of NPV, payback, IRR

- Issues with:

- Mutually exclusive projects

- Unconventional cash flows