Discounted Cash Flow Valuation

Chapter 6

Created by David Moore, PhD

Key Concepts

Extend our discussion of TVM- Add multiple cash flows. (Payment)

- Grow cash flows and what if cash flows go on forever.

- How are interest rates quoted.

- How are loans structured.

Cash Flows (Payments)

Valuing a Stream of Cash Flows

- Often time we will have multiple cash flows on our timeline.

- Investment (factory, new store, retirement) , debt repayment (mortgage, student loan, interest), salary, bonds, stocks...

- We already have the tools to do this.

- Compute the PV of each cash flow.

- Sum the present values

Present Value of Cash Flows

$PV=C_0+\frac{C_1}{(1+r)}+\frac{C_2}{(1+r)^2}+\frac{C_3}{(1+r)^3}+...+\frac{C_N}{(1+r)^N}$

$FV=C_N+C_{N-1}(1+r)^1+C_{N-2}(1+r)^2+$

$C_{N-3}(1+r)^3+...+C_{N-(N-1)}(1+r)^{N-(N-1)}$

Example 1

You think you will be able to deposit $\$$4,000 at the end of each of the next three years into an account earning 8% interest. You currently have $\$$7,000? How much will you have in three years? Four years? Twenty years?Solving with TVM Calculator: Ex 1

You think you will be able to deposit $\$$4,000 at the end of each of the next three years into an account earning 8% interest. You currently have $\$$7,000? How much will you have in three years? Four years? Twenty years?Future Value (FV)= $21,803.58

Payment(PMT)= -$4000

Rate(I%)= 8%

N= 3

Present Value(PV)= -$7000

Solving with TVM Calculator: Ex 1

You think you will be able to deposit $\$$4,000 at the end of each of the next three years into an account earning 8% interest. You currently have $\$$7,000? How much will you have in three years? Four years? Twenty years?Future Value (FV)= $27,574.87

Payment(PMT)= -$4000

Rate(I%)= 8%

N= 4

Present Value(PV)= -$7000

Solving with TVM Calculator: Ex 1

You think you will be able to deposit $\$$4,000 at the end of each of the next three years into an account earning 8% interest. You currently have $\$$7,000? How much will you have in three years? Four years? Twenty years?Future Value (FV)= $215,674.56

Payment(PMT)= -$4000

Rate(I%)= 8%

N= 20

Present Value(PV)= -$7000

Example 2 - Your Turn

You are offered an investment that pays $\$$1,000 at the end of each year for the next 4 years. The discount rate is 4%. What is the maximum you would be willing to pay for this investment.- Solve using a timeline

- Solve using TVM calculator

Example 3 Uneven cash flows

You are considering an investment that will pay you $\$$1,000 in one year, $\$$2,000 in two years and $\$$3,000 in three years. If you want to earn 10% per year on your money, how much would you be willing to pay (today) for this investment?Hockey Example

Hockey Contracts

On July 1, 2018 two NHL superstars and Canadian heroes signed long term contracts. Drew Doughty decided to stay in LA for 8 years, $\$$88 million. John Tavares left the failing NYI to join the future Stanley Cup Champion's, the blue and white, pride of Canada, Toronto Maple Leafs. Since he left his originally team he could only sign for 7 years. He signed a $\$$77 million dollar deal. John was represented by CAA (headquartered in LA) and Drew represented himself. Note that each players AAV is $\$$11 Million.Salary Breakdown

Here is their salary breakdown:| Year | Doughty | Tavares |

|---|---|---|

| 1 | $\$$12,000,000 | $\$$15,900,000 |

| 2 | $\$$10,000,000 | $\$$15,900,000 |

| 3 | $\$$11,000,000 | $\$$12,000,000 |

| 4 | $\$$11,000,000 | $\$$9,350,000 |

| 5 | $\$$11,000,000 | $\$$7,950,000 |

| 6 | $\$$11,000,000 | $\$$7,950,000 |

| 7 | $\$$11,000,000 | $\$$7,950,000 |

| 8 | $\$$11,000,000 |

Contract PV

| Rate | Doughty | Tavares | Difference |

|---|---|---|---|

| 0.00% | $\$$88,000,000 | $\$$77,000,000 | $\$$11,000,000 |

| 1.00% | $\$$84,178,258.23 | $\$$74,430,049.81 | $\$$9,748,208.42 |

| 5.00% | $\$$71,140,691.83 | $\$$65,434,307.17 | $\$$5,706,384.65 |

| 8.00% | $\$$63,281,615.49 | $\$$59,811,659.07 | $\$$3,469,956.41 |

| 12.00% | $\$$54,739,700.70 | $\$$53,490,205.41 | $\$$1,249,495.29 |

| 15.03% | $\$$49,425,668.13 | $\$$49,425,668.13 | $\$$0.00 |

| 20.00% | $\$$42,347,646.72 | $\$$43,821,242.18 | -$\$$1,473,595.45 |

Annuities and Perpetuities

Annuities

- If the first payment occurs at the end of the period, it is called an

ordinary annuity. - If the first payment occurs at the beginning of the period, it is called an

annuity due

Annuity Formulas

$PV=C[\frac{1-\frac{1}{(1+r)^t}}{r}]$

$FV=C[\frac{(1+r)^t-1}{r}]$

Perpetuities

$PV=\frac{C}{r}$

Example 1: Ordinary Annuity vs Annuity Due

You are saving for a new house, and you put $\$$10,000 per year in an account paying 8% per year. The first payment is made today. How much will you have at the END of 3 years?- What if payment is at the end of the period?

Example 2: Present Value

Suppose you win the Publishers Clearinghouse $\$$10 million sweepstakes. The money is paid in equal annual installments of $\$$333,333.33 over 30 years. If the appropriate discount rate is 5%, how much is the sweepstakes actually worth today? (This is an Ordinary Annuity)- Solve using formula.

- Solve using financial calculator.

- Repeat 1) and 2) for an Annuity Due.

Example 3: Monthly Compounding

Suppose you want to finance the purchase of a new $\$25,000$ car. You can take out a 5-year loan at 8%- What is your monthly payment?

- What if this was an annuity due? (pay at beginning of month.)

- What if the loan is 7 years at 10%? How much more or less do you end up paying over the life of the loan.

Example 4: Quarterly Compounding

You borrow $\$$6,000 from your generous parents to move into your first apartment. You look at your budget and decide you can pay them $\$$524.50 per quarter for the next 4 years. What is the quarterly interest rate? (Remember signs!)- What about if you paid them at the beginning of the quarter?

Sign Reminder

A good way to remember signs:- Cash outflows are negative

- Cash inflows are positive

Try:

- You borrow 10,000 and make payments of 940 a year for 15 years. What is the rate?

- There is an investment that pays 300 a year for 3 years how much are you willing to pay for it today? 5% interest.

Example 5: Future Value

Suppose you begin saving for your retirement by depositing $2,000 per year in an IRA (Individual Retirement Account) If the (annual) interest rate is 7.5%, how much will you have in 40 years?- Solve using formula.

- Solve using financial calculator.

- Repeat 1) and 2) for an Annuity Due.

Example 6: Perpetuity

You just won the lottery, and you want to endow a professorship at your alma mater (Thanks!!). You are willing to donate $\$$4 million of your winnings for this purpose. If the university earns 5% per year on its investments, and the professor will be receiving her first payment in one year, how much will the endowment pay her each year?Growing Annuity and Perpetuity

Growing Annuity

$PV=\frac{C}{r-g}[1-(\frac{1+g}{1+r})^t]$

Reminder: Cash Flow C occurs at t=1, t=2 cash flow is C(1+g).

Growing Perpetuity

$PV=\frac{C}{r-g}$

Important: Growth rate (g) must be less that interest rate r. If g>r the formula will not work!

Example 1: Growing Annuity

Your great Uncle Bud has left you an estate. You will receive $\$$10,000 next year, $\$$11,000 the following year, $\$$12,100 the year after that, and so on for the next 20 years. You'd rather have the money now, if your discount rate is 8%, what is the minimum you would be willing to sell this inheritance for?Example 2: Growing Perpetuity

Revisit Endowment. You just won the lottery, and you want to endow a professorship at your alma mater (Thanks!!). You were willing to donate $\$$4 million of your winnings for this purpose. If the university earns 5% per year on its investments, and the professor will be receiving her first payment in one year of $\$$200,000. Now, take into account the inflation rate so that the payment grows to adjust for inflation. Assume 2% inflation. How much more or less do you need to donate now for the salary to grow with inflation?Interest Rates

Interest Quotes

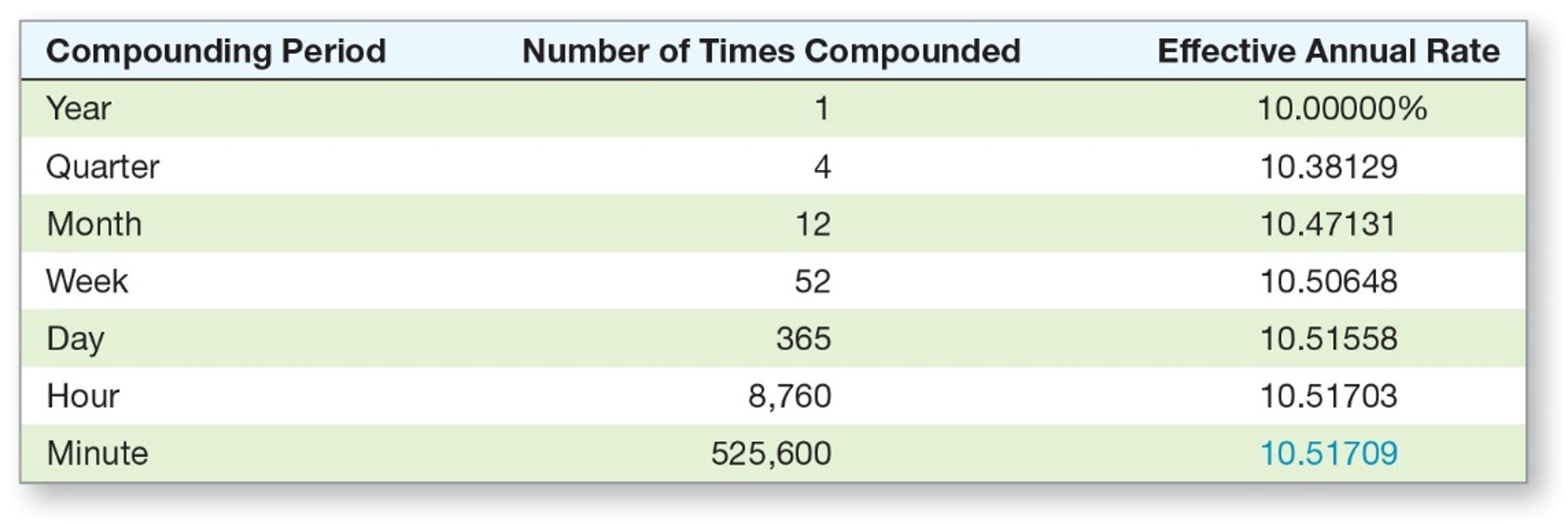

- In practice interest is compounded quarterly, monthly, or daily.

- To make things easier (but not really) interest rates are quoted annually

- This rate is known as APR, but is this the correct rate for decision making??

APR vs EAR

Annual Percentage Rate (APR)- Most common way of quoting

- NOT THE ACTUAL PRICE OF MONEY; ignores compounding

- APR ≤ EAR

Effective Annual Rate (EAR)

- Actual rate paid or received after accounting for compounding that occurs during the year

- Given two rates with different compounding, you should...

USE EAR FOR COMPARISON

Formulas

$APR = \text{Periodic rate x m}$ , where:

m= # of compounding periods/year

Note: Periodic rate= APR/m

$EAR=[1+\frac{APR}{m}]^m-1$,

Example 1: APR

What is the APR if the monthly rate is .5%? semiannual rate is .5%?Example 2: EAR

What is the EAR if the quoted rate is 10% compounded quarterly? monthly?Example 3 Comparing rates

You are looking at two savings accounts. First account pays 5.25% APR with daily compounding. The second one pays 5.3% APR with semiannual compounding. Which account should you choose?Example 4 EAR to APR

Suppose you want to earn an effective rate of 12% and you are looking at an account that compounds on a monthly basis. What is the APR?Example 5 Credit Cards

Continuous Compounding

$EAR=e^q-1$

What is the EAR of 7% compounded continuously?

Compounding periods $\ne$ Payment periods

$r=(1+\frac{APR}{m})^{\frac{m}{n}}-1$, where:

m= # of compounding periods per year

n= # of payment periods per year

Example: Credit cards

You make monthly payments on your credit card but the interest is compounded daily. Your balance is currently $\$2432$, the APR on your card is 25.75% and you are making $\$80$ payments. How many months until your balance is zero assuming no more charges are made.Loan Types

Loan Types

- Pure discount loan: Pay a single lump sum at the end of the loan.

- Interest-only loan: Borrowers pay interest each period, repay principal at some point in the future.

- Amortized loan: Borrower makes regular principal reductions.

Pure Discount Loan

Examples: Treasury Bills (T-bill)If a T-bill promises to pay $10,000 in 12-months and the market rate is 7%. How much will the bill sell for?

Interest-Only Loan

This will be the primary topic of Chapter 7. Bonds function as interest only loans.Amortized Loan

This is the loan you are most familiar with. Examples are mortgages, student loans, car loans, credit cards (somewhat).Key Learning Outcomes

- Annuities and Perpetuities

- Time value of Money with different compounding periods

- Annuity due vs Ordinary annuity

- Growing Annuity or Perpetuity

- EAR and APR

- Continuous compounding

- Loan Types