Financial Statements, Taxes, and Cash Flow

Chapter 2

Created by David Moore, PhD

Key Concepts

Note: This chapter is largely a review of key accounting concepts.

- Balance sheet

- Income statement

- Taxes

- Cash flow

Financial Statements

- Mandatory

- Public

- Large set of reporting rules

- Most useful source of information on public companies.

The Balance Sheet

Balance Sheet

Balance Sheet Identity:

- Assets= Liabilities + Stockholder's Equity

Summarizes what the firm owns (assets), owes (liabilities), and the difference (stockholder's equity).

| Assets | Liabilities | ||

|---|---|---|---|

| Current Assets | Current Liabilities | ||

| Cash | 1,500 | Accounts Payable | 600 |

| Accounts Receivable | 500 | Notes Payable | 300 |

| Inventory | 750 | ||

| Total | 2,750 | Total | 900 |

| Fixed Assets | |||

| Property Plant and Equipment | 5,000 | Long-term Debt | 3,500 |

| Shareholders' Equity | |||

| Common stock and paid-in surplus | 1,000 | ||

| Retained Earnings | 2,350 | ||

| Total | 3,350 | ||

| Total Assets | 7,750 | Total Liabilities + Shareholders' Equity | 7,750 |

Asset Tangibility

Assets can be

Things to consider

- Liquidity

- Debt vs Equity

- Market Value vs Book Value

Liquidity

Trade off:

- Liquid firms are less likely to experience financial distress.

- Liquid assets typically earn a lower return

Debt vs Equity

- Creditors are paid first; Shareholders get residual.

- Other term for debt is:

Financial leverage - Cost and benefits of financial leverage (debt) discussed more in later chapters

Market Value vs Book Value

The balance sheet provides the book value of the assets, liabilities, and equity.

Market value is the price at which the assets, liabilities, or equity can actually be bought or sold.

Income Statement

The Income Statement

- Generally: $\text{Revenue}-\text{Expenses}=\text{Income}$

- Net Income $\neq$ cash flow

- GAAP

- Recognition and matching

- Non-cash items: Depreciation

Income Statement: Example

| Revenue | ||

|---|---|---|

| Net Sales | + | 1,509 |

| Expenses | ||

| Cost of Goods Sold | - | 750 |

| Depreciation | - | 65 |

| Earnings Before Interest and Taxes (EBIT) | Revenue - Operating Expenses | 694 |

| Interest Paid | - | 70 |

| Taxable Income | EBIT - Interest Paid | 624 |

| Taxes | Taxable Income $\times$ Tax Rate | 131 |

| Net Income (NI) | Taxable Income - Taxes | 493 |

| Dividends | 293 | |

| Retained Earnings | 200 |

Taxes

- Tax code is complicated

- This isn't a corporate tax class

- Marginal vs average tax rate

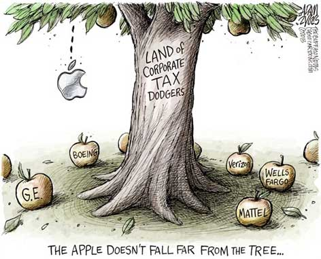

What kind of taxes are companies paying?

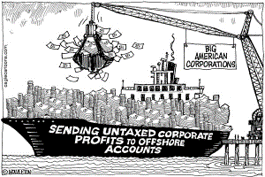

Foreign Earnings

How are foreign earnings taxed?

Repatriation and Tax Cuts

Corporate Inversion

What is a corporate inversion?

(not)Fun fact: You owe taxes if you own stock in US company even if you don’t sell shares!! (See WSJ article)

Cash Flow

Cash Flow

Cash flow identity:

$\text{Cash flow from assets}=$

$\text{Cash flow to creditors}+\text{Cash flow to stockholders}$

Cash Flow from Assets (CFFA)

$\text{CFFA}=\text{Cash Flow to Creditors}+\text{Cash Flow to Stockholder}$- Known as

free cash flow

$\text{CF}_{\text{Assets}}=\text{OCF}-\text{NCS}-\Delta\text{NWC}$,

where:

$\text{OCF}=\text{Operating Cash Flow}$

$\text{NCS}=\text{Net Capital Spending}$

$\Delta\text{NWC}=\text{Change in Net Working Capital}$

Operating Cash Flow (OCF)

OCF=EBIT +Depreciation-Taxes| Revenue | ||

|---|---|---|

| Net Sales | + | 1,509 |

| Expenses | ||

| Cost of Goods Sold | - | 750 |

| Depreciation | - | 65 |

| Earnings Before Interest and Taxes (EBIT) | Revenue - Operating Expenses | 694 |

| Interest Paid | - | 70 |

| Taxable Income | EBIT - Interest Paid | 624 |

| Taxes | Taxable Income $\times$ Tax Rate | 131 |

| Net Income (NI) | Taxable Income - Taxes | 493 |

Net Capital Spending (NCS)

NCS$_t$=Fixed Assets$_t$-Fixed Assets$_{t-1}$+Depreciation| Assets | 2017 | 2016 | Liabilities | 2017 | 2016 |

|---|---|---|---|---|---|

| Current Assets | Current Liabilities | ||||

| Cash | 1,500 | 1,300 | Accounts Payable | 600 | 800 |

| Accounts Receivable | 500 | 800 | Notes Payable | 300 | 150 |

| Inventory | 750 | 1000 | |||

| Total | 2,750 | 3,100 | Total | 900 | 950 |

| Fixed Assets | |||||

| Property Plant and Equipment | 5,000 | 4,500 | Long-term Debt | 3,500 | 3,200 |

NCS=5000-4500+65=565

Change in Net Working Capital($\Delta$NWC)

NWC$_t$=Current Assets$_t$ - Current Liabilities$_t$$\Delta$NWC$_t$=NWC$_t$-NWC$_{t-1}$

| Assets | 2017 | 2016 | Liabilities | 2017 | 2016 |

|---|---|---|---|---|---|

| Current Assets | Current Liabilities | ||||

| Cash | 1,500 | 1,300 | Accounts Payable | 600 | 800 |

| Accounts Receivable | 500 | 800 | Notes Payable | 300 | 150 |

| Inventory | 750 | 1000 | |||

| Total | 2,750 | 3,100 | Total | 900 | 950 |

| Fixed Assets | |||||

| Property Plant and Equipment | 5,000 | 4,500 | Long-term Debt | 3,500 | 3,200 |

$\Delta$NWC=(2,750-900)-(3,100-950)=-300

Cash Flow From Assets

CFFA=Cash Flow to Creditors+Cash Flow to StockholderCF$_{Assets}$=OCF-NCS-$\Delta$NWC

CF$_{Assets}$=628-565-(-300)=363

Cash Flow to Creditors

CFFA=Cash Flow to Creditors+Cash Flow to StockholderCF$_{Creditors}$=Interest Paid - Net New Borrowing

CF$_{Creditors}$=Interest Paid - (Long Term Debt$_t$ - Long term Debt$_{t-1}$)

| Balance Sheet | Income Statement | ||||

|---|---|---|---|---|---|

| Liabilities | 2017 | 2016 | Net Sales | 1509 | |

| Current Liabilities | Cost of Goods Sold | 750 | |||

| Accounts Payable | 600 | 800 | Depreciation | 65 | |

| Notes Payable | 300 | 150 | EBIT | 694 | |

| Interest paid | 70 | ||||

| Total | 900 | 950 | Taxable Income | 624 | |

| Taxes | 131 | ||||

| Long-term Debt | 3,500 | 3,200 | Net Income | 493 |

CF$_{Creditors}$=70-(3,500-3,200)=-230

Cash Flow to Shareholders

CFFA=Cash Flow to Creditors+Cash Flow to StockholderCF$_{Stockholders}$=Dividends Paid-Net New Equity Issuance

CF$_{Stockholders}$=Dividends Paid-(Common Stock$_t$ - Common Stock$_{t-1}$)

| Balance Sheet | Income Statement | ||||

|---|---|---|---|---|---|

| 2017 | 2016 | EBIT | 694 | ||

| Shareholder's Equity | Interest paid | 70 | |||

| Common Stock | 1,000 | 1,300 | Taxable Income | 624 | |

| Retained Earnings | 2,350 | 2,150 | Taxes | 131 | |

| Total | 3,350 | 3,450 | Net Income | 493 | |

| Dividends | 293 | ||||

| Retained Earnings | 200 |

CF$_{Stockholders}$=293-(1,000-1,300)=593

Does it balance?

CFFA=Cash Flow to Creditors+Cash Flow to StockholderCF$_{Assets}$=363

CF$_{Creditors}$=-230

CF$_{Stockholders}$=593

$363=-230+593$

$363=363$

Summary

Cash Flow IdentityCF$_{Assets}$=CF$_{Stockholders}$+CF$_{Creditors}$

Cash Flow from Assets

CF$_{Assets}$=OCF-NCS-$\Delta$NWC, where:

OCF=EBIT+Depreciation-Taxes

NCS=Net Fixed Assets$_t$-Net Fixed Assets$_{t-1}$+Depreciation

$\Delta$NWC=NWC$_t$-NWC$_{t-1}$=(CA$_t$-CL$_t$)-(CA$_{t-1}$-CL$_{t-1}$)

Cash Flow to Creditors

CF$_{Creditors}$=Interest Paid-Net New Borrowing=Interest Paid-(Long Term Debt$_t$-Long Term Debt$_{t-1})$

Cash Flow to Stockholders

CF$_{Stockholders}$=Dividends Paid-Net New Equity Raised =Dividends Paid-(Common Stock$_t$-Common Stock$_{t-1}$)

Cash Flow Problem

Sales=600CGS=300

Depreciation=150

Interest=30

Taxes=21% (round to nearest integer)

Dividends=30

Beg NFA=500 End NFA=750, NFA=Net Fixed Assets

Beg CA=2130 End CA=2260 Beg CL=1620 End CL=1710

No new equity

What is CF to creditor and net new borrowing?

CF$_C$=-195 Net New Borrowing=225

Sources of Financial Information

- Financial information is abundant and readily accessible.

- The following are some common sources:

- Annual reports (often on company websites)

- SEC EDGAR

- Any required reporting for public companies can be found here

- NYSE

- NASDAQ

- Yahoo Finance

- Seeking Alpha

- Wall Street Journal

- Bloomberg

Key Learning Outcomes

- Reading financial statements

- Differentiate: book vs market; financial vs accounting

- Corporate Taxes and Foreign Earnings

- Understand and calculate cash flows