Dividends and Payout Policy

Chapter 17

Created by David Moore, PhD

Topics

- Dividends and Share Repurchases

- Methods

- Costs and Benefits

- Stock Dividends and Stock Splits

Dividends

Cash Dividends

- Regular cash dividend: cash payments made directly to stockholders, usually each quarter

- Special cash dividend: one-time event with no expectation of being repeated

- Liquidating dividend: some or all of the business has been sold

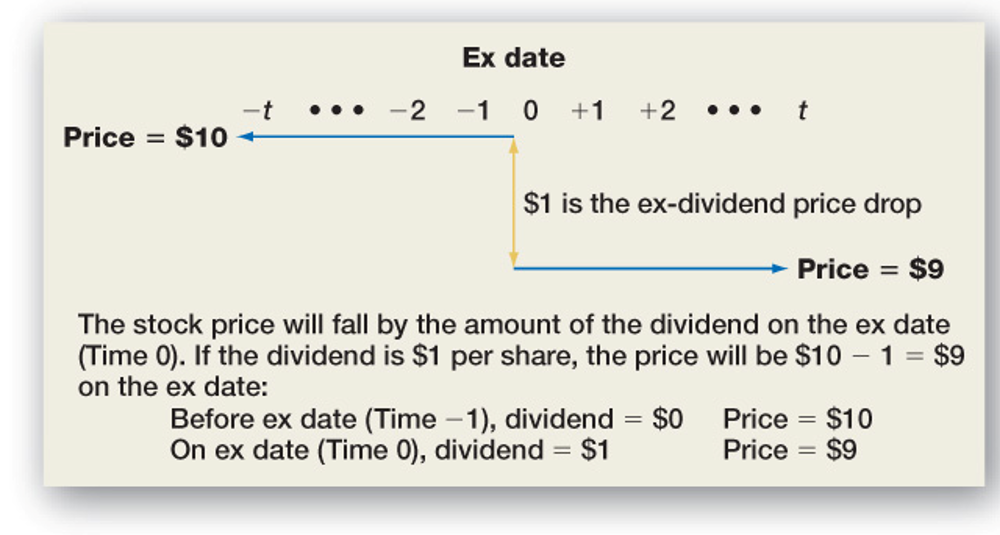

Dividend Payment Chronology

- Declaration Date: Board declares the dividend and it becomes a liability of the firm

- Ex-dividend Date

- Occurs two business days before date of record

- If you buy stock on or after this date, you will not receive the upcoming dividend

- Stock price generally drops by approximately the amount of the dividend

- Date of Record: holders of record are determined, and they will receive the dividend payment

- Date of Payment: checks are mailed (funds are transferred)

The Ex-Dividend Day Price Drop

Example

Factors Favoring a Low Payout

- Taxes

- Individuals in upper income tax brackets might prefer lower dividend payouts, with their immediate tax consequences, in favor of higher capital gains

- Flotation costs

- Low payouts can decrease the amount of capital that needs to be raised, thereby lowering flotation costs

- Dividend restrictions

- Debt covenants may limit the percentage of income that can be paid out as dividends

Factors Favoring a High Payout

- Desire for current income

- Individuals in low tax brackets

- Groups that are prohibited from spending principal (trusts and endowments)

- Uncertainty resolution

- No guarantee that the higher future dividends will materialize

- Taxes

- Dividend exclusion for corporations (70%)

- Dividends versus capital gains irrelevant to tax-exempt investors

Clientele Effect

Share Repurchases (Stock Buybacks)

What is a buyback

- Comparison to Dividends

- Repurchases returns cash from the firm to the stockholders

- Same as cash dividend in the absence of taxes and transactions costs

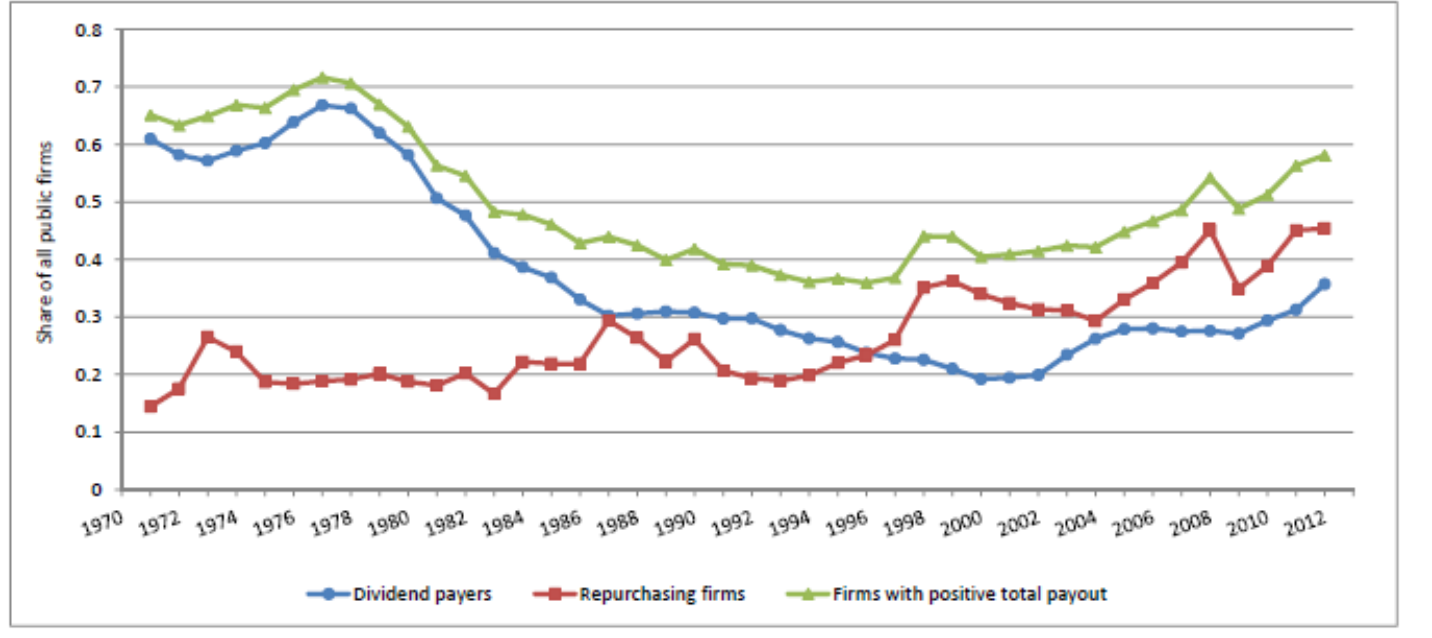

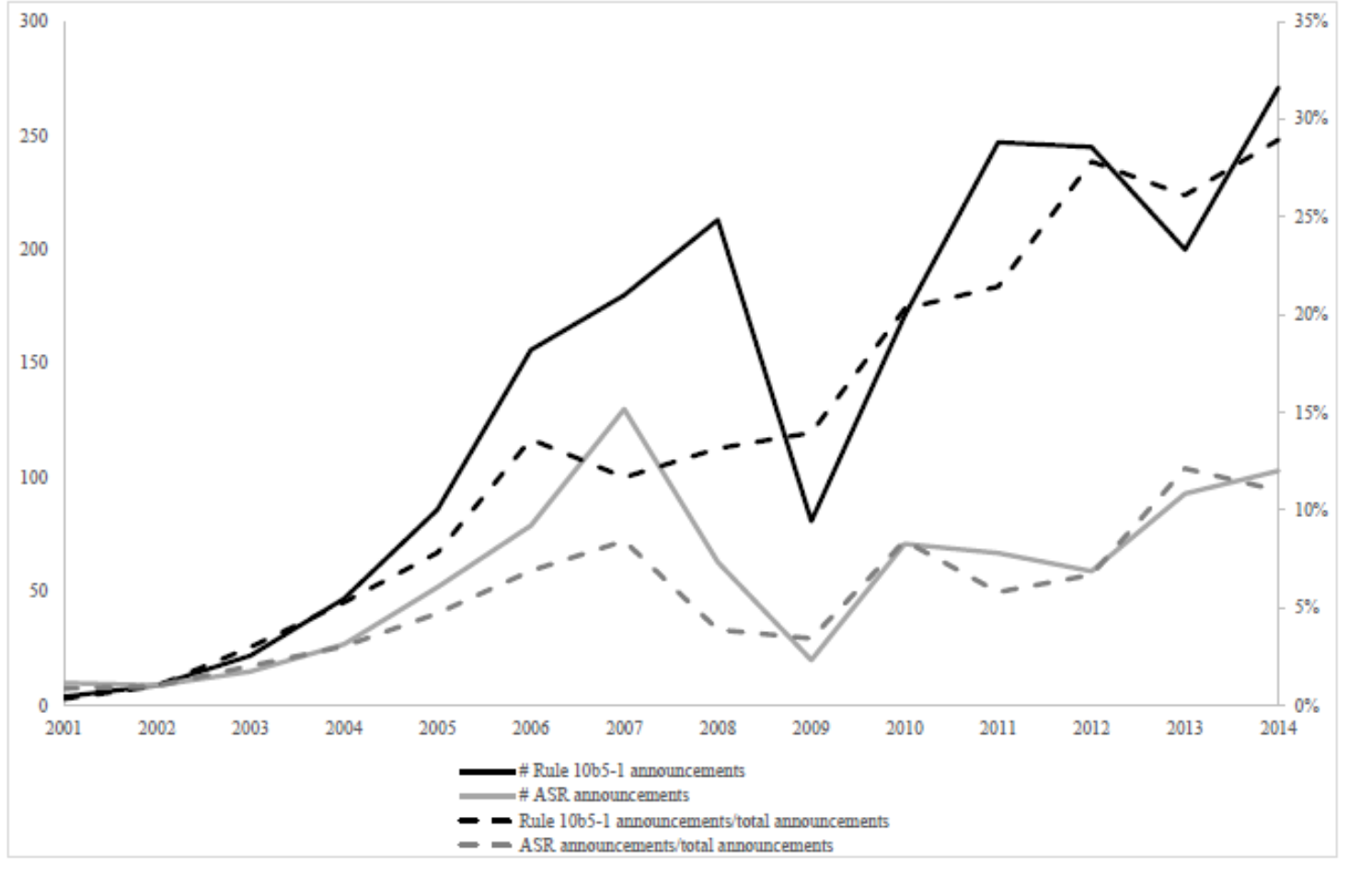

Payout Choice 1970-2014

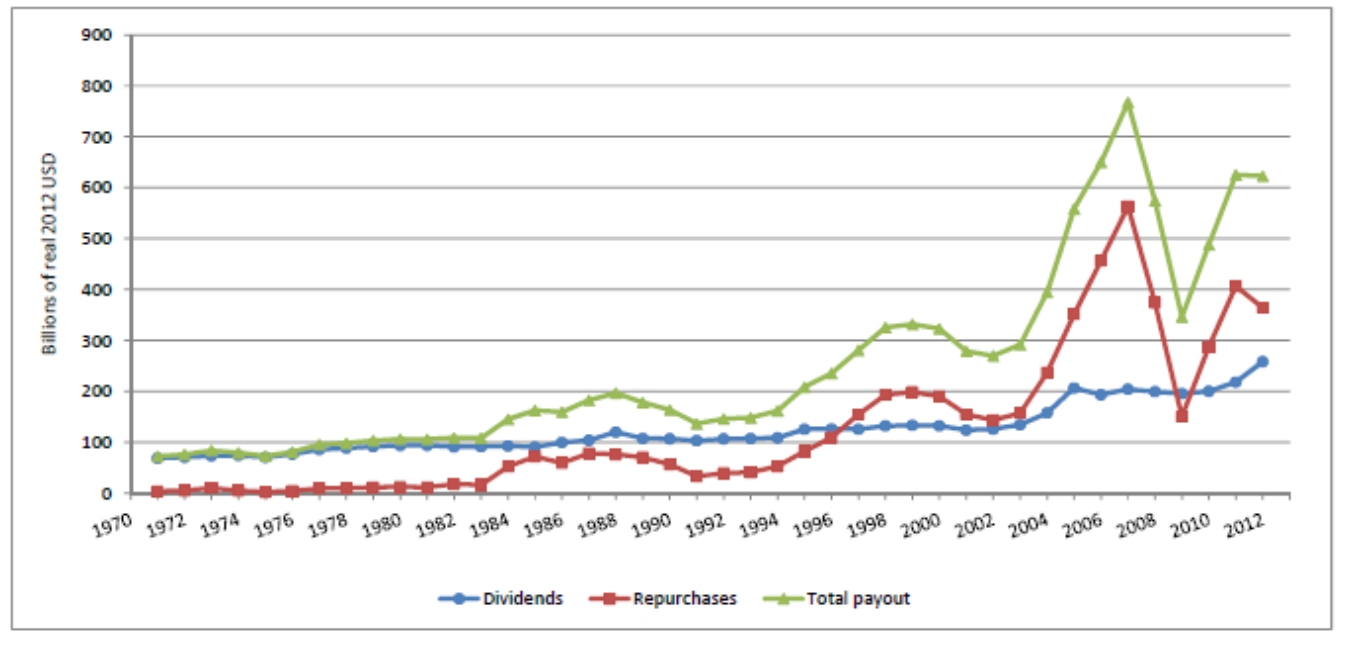

Payout Policy 1970-2014: Dollars Spent

Repurchase Methods

- Open market repurchase (OMR) = company buys its own stock in the open market (most common)

- Rule 10b5-1 Preset Repurchase = firms set up a preset plan to repurchase shares (becoming more common 20-30%)

- Accelerated share repurchase(ASR) = firms buy back shares immediately from an investment back (gets shares immediately)

- Tender offer = company states a purchase price and a desired number of shares to be bought (becoming less common)

- Targeted repurchase or Privately negotiated = firm repurchases shares from specific individual shareholders

Preset and Accelerated Repurchases

Taxes

- Reminder: Cash Dividends

- No investor control over timing or size

- Taxed as ordinary income (if ordinary)

- Repurchases:

- Allows investors to decide if they want a current cash flow

- Taxed only if:

- They choose to sell AND

- They reap a capital gain on the sale

- Gain may qualify as lower taxed capital gains if shares owned more than one year.

Repurchase Motivations

- Undervaluation: management believes stock price is too low, buying back shares is good investment

- Free cash flow: a repurchase signals that management may not have any good investment and is returning excess capital to shareholders

- Dilution: options cause dilution (increase in shares outstanding) and repurchases help reverse this

- EPS motivated(management incentive): can use a repurchase to meet analyst earnings expectations by decreasing shares outstanding

- Takeover defense: repurchases increase the price at which an acquirer must pay

Repurchase Announcement Example

Apple

On May 1, 2018, the Company announced the Board of Directors had authorized a new program to repurchase up to $100 billion of the Company's common stock. The remaining $\$$9.6 billion repurchased during the third quarter of 2018 was in connection with the new share repurchase program. The Company's new share repurchase program does not obligate it to acquire any specific number of shares. Under this program, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Dividend Announcement Example

Apple

On May 1, 2018, the Company also announced the Board of Directors raised the Company's quarterly cash dividend from 0.63 to 0.73 per share, beginning with the dividend paid during the third quarter of 2018. The Company intends to increase its dividend on an annual basis, subject to declaration by the Board of Directors. The Company plans to use current cash and cash generated from ongoing operating activities to fund its share repurchase program and quarterly cash dividend.

Payout Facts and Figures

- Aggregate dividend and stock repurchases are massive and have increased steadily.

- Dividends heavily concentrated among a small number of large firms.

- Managers very reluctant to cut dividends. (Dividends are "sticky"

- Managers smooth dividends, raising them slowly as earnings grow.

- Stock prices react to unanticipated changes in dividends and to repurchase announcements

- Repurchases are much more flexible than dividends, main reason managers prefer repurchases over dividends

- Average completion rate of repurchases around 80%

Information Content

- Changes in the dividend signal management's view concerning the firm's future prospects

- Stock repurchases signal that management believes the current stock price is low or distributing excess capital

- ASRs, and 10b5-1s send a more positive signal than open market repurchases because the company is increasing commitment to follow through

- Positive market reaction to repurchase announcement, increasing in level of commitment

Pros and Cons: Dividends

- Pros

- Cash dividends underscore good results and provide support to stock price

- Dividends may attract institutional investors

- Stock price usually increases with a new or increased dividend

- Dividends absorb excess cash and may reduce agency costs

- Cons

- Dividends are taxed to recipients

- Inflexible: Dividends can reduce internal sources of funding

- May force firm to forgo positive NPV project

- May require external financing

- Sticky: once established, dividends cuts are hard to make without adversely affecting a firm’s stock price.

Pros and Cons: Repurchases

- Pros

- More flexible relative to dividends

- Can help meet EPS and undue dilution

- Stock price usually increases with an announced program

- Repurchases absorb excess cash and may reduce agency costs

- Cons

- Less of a commitment signal relative to dividends

- Can be used to meet executive compensation goals

- Companies are bad "timers"

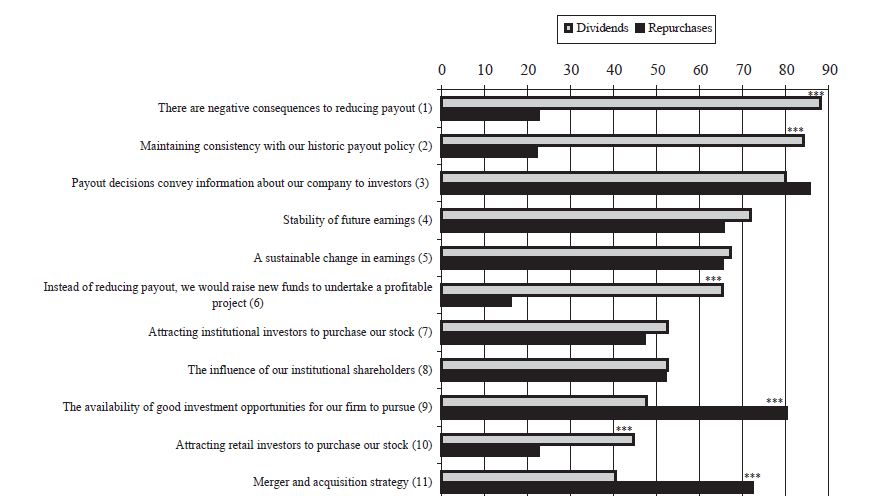

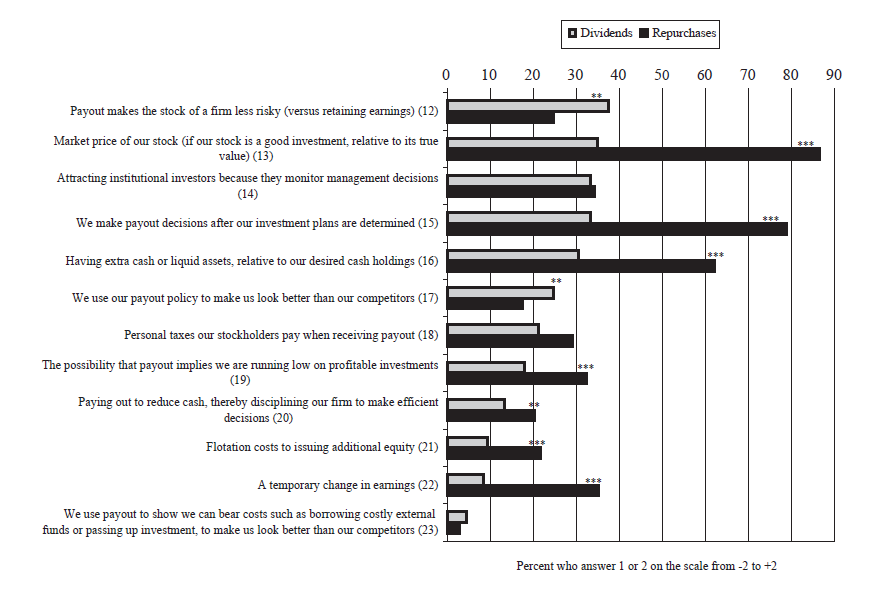

What Do Manager's Say?

What Do Manager's Say?

Stock Dividends and Splits

Stock Dividends

- Distribute additional shares of stock instead of cash (does not change owner's equity)

- Increases the number of outstanding shares

- Small stock dividend: Less than 20 to 25%

- If you own 100 shares and the company declared a 10% stock dividend, you would receive an additional 10 shares

- Large stock dividend: more than 20 to 25%

Stock Split

- Essentially the same as a stock dividend except expressed as a ratio

- For example, a 2-for-1 stock split is the same as a 100% stock dividend

- Stock price is reduced when the stock splits

- Common explanation for split is to return price to a "more desirable trading range"

Reverse Stock Splits

- Reverse Split reduces number of shares outstanding and increase the share price.

- For example, a 1-for-5 stock split replaces every 5 shares of stock with one share

- Motives:

- Transactions costs may be less for investors

- Liquidity might be improved

- Too low a price not considered "respectable"

- Exchange minimum price per share requirements

Example Problems

Example 1: Dividend vs Repurchase

Entertainment 720 Inc. has a market value of equity of $\$$1,000,000, excess cash of $\$$300,000, and net income of $\$$49,000. There are 100,000 shares outstanding.- What is the current stock price, EPS, and P/E ratio?

- What if the excess cash is used to pay a dividend. What is the stock price, EPS, P/E ratio, and Shareholder wealth (per share)? Ignore all frictions, taxes, and imperfections.

- What if the excess cash is used to repurchase shares. What is the stock price, EPS, P/E ratio, and Shareholder wealth (per share)? Ignore all frictions, taxes, and imperfections.

Example 2: Stock Dividends and Splits

Best Bikes Buddy Co. (BBB) currently has 325,000 shares outstanding that sell for $\$$28 each. What will the share outstanding and stock price be if the following occur: (Ignore all frictions, taxes, and imperfections.)- 2 for 1 stock split

- 7 for 5 stock split

- 30% stock dividend

- 2 for 3 reverse stock split

Key Learning Outcomes

- Dividends

- Types and chronology

- Low vs high payout factors

- Clientele effect

- Repurchases

- Trends

- Methods and Motives

- Tax effects

- Payout Facts

- Information content, signaling, and market reactions

- Stock dividends and splits