Cost of Capital

Chapter 14

Created by David Moore, PhD

Topics

- WACC

- Cost of Equity

- Cost of Debt

- Capital cost weights

- Issues with WACC

Why Cost of Capital is Important?

- We know that the return earned on assets depends on the risk of those assets

- The return to an investor is the same as the cost to the company

- Our cost of capital provides us with an indication of how the market views the risk of our assets

- Knowing our cost of capital can also help us determine our required return for capital budgeting projects

Required Return

- The required return is the same as the appropriate discount rate and is based on the risk of the cash flows

- We need to know the required return for an investment before we can compute the NPV and make a decision about whether or not to take the investment

- We need to earn at least the required return to compensate our investors for the financing they have provided

Financial Policy and Cost of Capital

Big picture

- A firm's cost of capital reflects the required return on the firm's assets as a whole

- A firm uses both debt and equity capital

- Cost of capital will be a mixture

Cost of Equity

- The cost of equity is the return required by equity investors given the risk of the cash flows from the firm

- Business risk

- Financial risk

- There are two major methods for determining the cost of equity

- Dividend Growth Model

- SML, or CAPM

DGM Approach: Reminder

$R_E=\frac{D_1}{P_0}+g$

DGM: Pros and Cons

- Advantages

- easy to understand and use

- Disadvantages

- Requires a dividend payment

- Requires growth rate to be constant

- Extremely sensitive to growth rate estimate

- Does not explicitly consider risk

SML Approach: Reminder

$R_E=R_f+\beta_E(E(R_M)-R_f)$

SML or CAPM: Pros and Cons

- Advantages

- Explicitly adjusts for systematic risk

- Applicable to all companies, as long as we can estimate beta

- Disadvantages

- Have to estimate the expected market risk premium, which does vary over time

- Have to estimate beta, which also varies over time

- We are using the past to predict the future, which is not always reliable

Cost of Debt

- The cost of debt is the required return on our company's debt

- We usually focus on the cost of long-term debt or bonds

- The required return is best estimated by computing the yield-to-maturity on the existing debt

- The cost of debt is NOT the coupon rate

Weighted Average Cost of Capital (WACC)

- We can use the individual costs of capital that we have computed to get our "average" cost of capital for the firm

- This "average" is the required return on the firm's assets, based on the market's perception of the risk of those assets

- The weights are determined by how much of each type of financing is used

Capital Structure Weights

- Notation

- E = market value of equity = # of outstanding shares times price per share

- D = market value of debt = # of outstanding bonds times bond price

- V = market value of the firm = D + E

- Weights

- $w_E = \frac{E}{V} =$ percent financed with equity

- $w_D=\frac{D}{V}=$ percent financed with debt

Taxes

- We are concerned with after-tax cash flows, so we also need to consider the effect of taxes on the various costs of capital

- Interest expense reduces our tax liability

- This reduction in taxes reduces our cost of debt

- Dividends are not tax deductible, so there is no tax impact on the cost of equity

WACC

$WACC=w_ER_E+w_DR_D(1-T_C)$

Large Example

Go Nuts for Donuts! Inc.

Go Nuts for Donuts! Inc. has 50,000,000 shares outstanding that currently trade at $\$$80 a share. The firm recently paid a dividend of $\$$3.5 and its past 5-year growth rate in dividends is 6%. It's systematic risk, measured by beta, is 1.15. The firm has $\$$1 billion in outstanding debt, face value. The current quote on the bond is 110 and the coupon rate is 9% (semi-annual coupon payments). The bonds have 15 years to maturity. Assume a tax rate of 40%. The market risk premium is 9% and the risk free rate is 5%.Solution: Cost of Equity

What is the Cost of Equity?

- Dividend Growth Model $R_E=\frac{D_1}{P_0}+g=\frac{3.5(1.06)}{80}+.06=.106375=10.64%$

- CAPM $R_E=R_f+\beta_E(E(R_M)-R_f)=5+1.15(9)=15.35%$

Solution: Cost of Debt

What is the Cost of Debt?

- N=15*2=30

- I%=3.927*2=$7.854=R_D$

- PV=-1100

- PMT=90/2=45

- FV=1000

What is the After-Tax Cost of Debt?

$R_D(1-T_C)=7.854(1-.4)=4.712%$

Solution: Weights

What are the capital structure weights?

- E=50,000,000*80= 4 billion

- D=1,000,000,000*1.1=1.1 billion

- V=4 + 1.1 = 5.1 billion

- $w_E=\frac{E}{V}=\frac{4}{5.1}=.7843$

- $w_D=\frac{D}{V}=\frac{1.1}{5.1}=.2157$

Solution

What is the WACC?

- Using DGM: $WACC=w_ER_E+w_DR_D(1-T_C)$

- Using CAPM: $WACC=w_ER_E+w_DR_D(1-T_C)$

$WACC=.7843(10.64)+.2157*(7.854(1-.4)=9.36$

$WACC=.7843(15.35)+.2157*(7.854(1-.4)=13.06$

Another Large Example

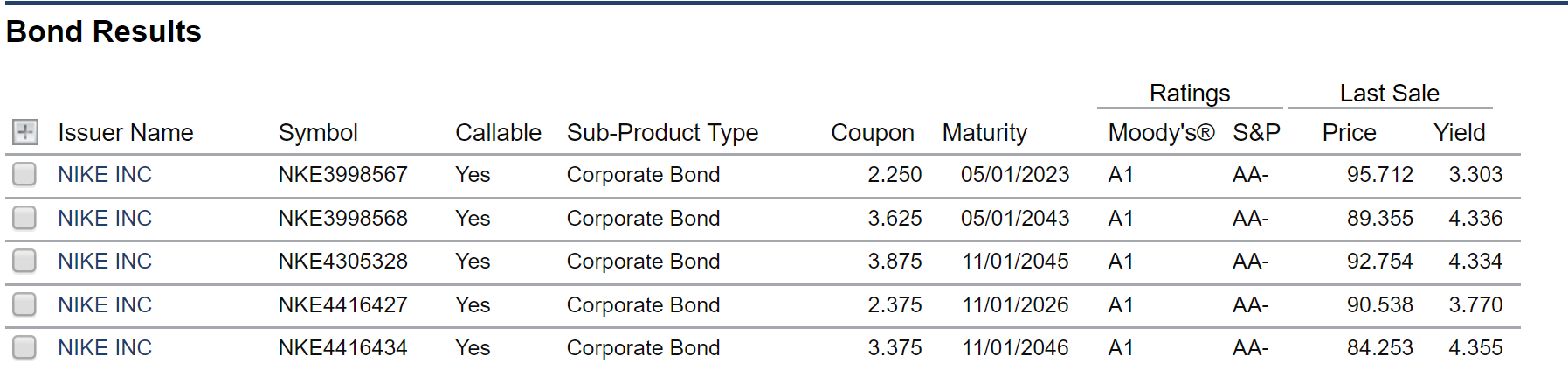

Nike (Using real data)

Use the Value line handout and the below data to calculate the WACC for Nike. Use the 10 year growth rate for dividends and the 2019 expected dividend. Assume a tax rate of 21%, a market risk premium of 8.75% and a risk free rate of 3%.

Note: The bonds maturing in 2023, 2043, and 2026 are worth 500 million (face value). The bonds maturing in 2045 and 2046 are worth 1 billion (face value).

Issues with WACC

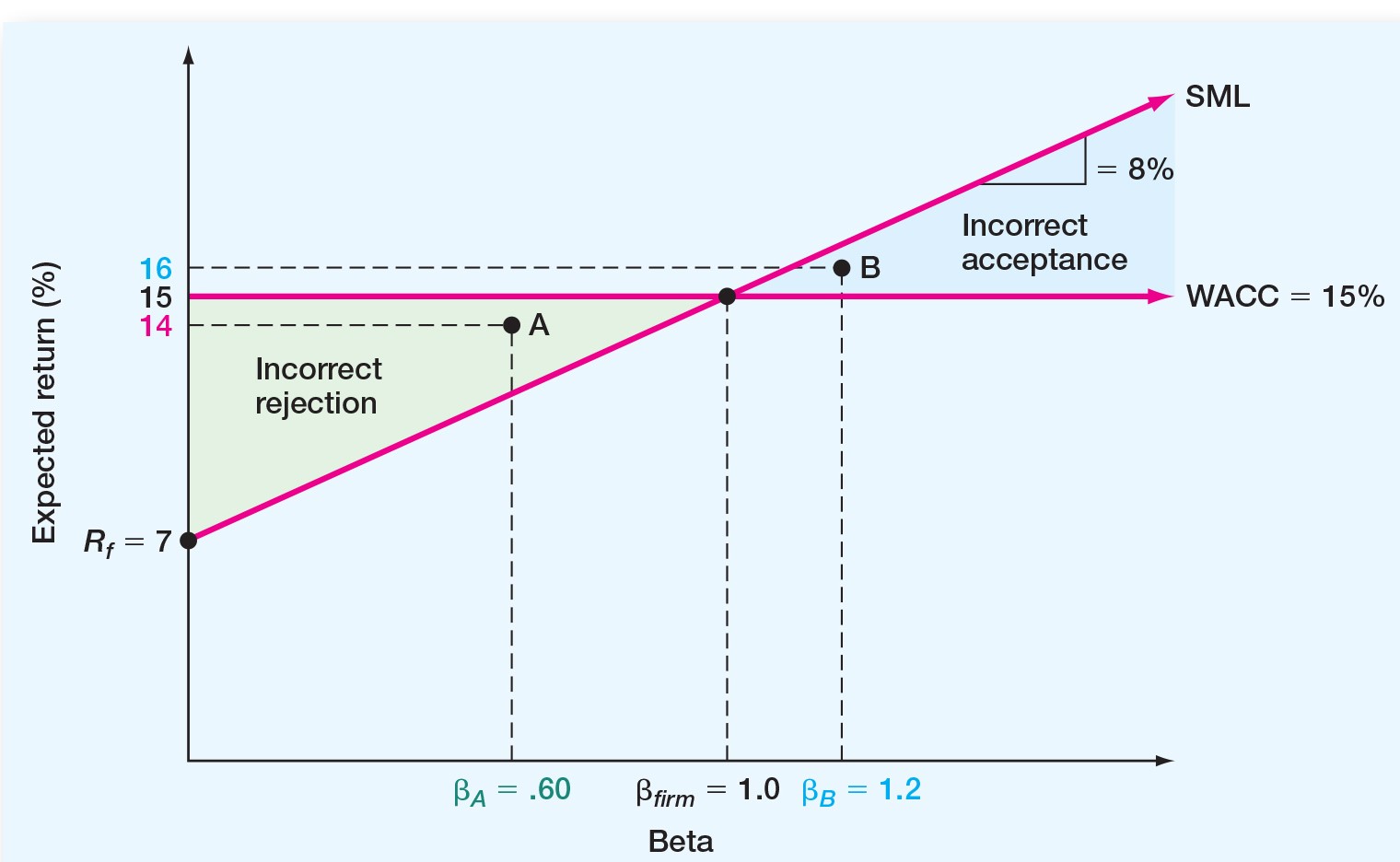

SML and WACC

Divisions and WACC

- Using firm-level WACC can lead to:

- Incorrectly accepting high risk projects if $\beta$ of project is higher

- Incorrectly rejecting low risk projects if $\beta$ of project is lower

- Solutions:

- Pure Play: Use similar investment(company) in marketplace

- Subjective: Make risk adjustments to WACC.

Extra Practice

Example 1

- Suppose your company has an equity beta of .58, and the current risk-free rate is 6.1%. If the expected market risk premium is 8.6%, what is your cost of equity capital?

- Suppose that your company is expected to pay a dividend of $\$$1.50 per share next year. There has been a steady growth in dividends of 5.1% per year and the market expects that to continue. The current price is $\$$25. What is the cost of equity?

- Suppose we have a bond issue currently outstanding that has 25 years left to maturity. The coupon rate is 9%, and coupons are paid semiannually. The bond is currently selling for $\$$908.72 per $\$$1,000 bond. What is the cost of debt?

Example 2

Suppose you have a market value of equity equal to $\$$500 million and a market value of debt equal to $475 million.Example 3

A corporation has 10,000 bonds outstanding with a 6% annual coupon rate, 8 years to maturity, a $\$$1,000 face value, and a $\$$1,100 market price. The company's 500,000 shares of common stock sell for $\$$25 per share and have a beta of 1.5. The risk free rate is 4%, and the market return is 12%. Assuming a 40% tax rate, what is the company’s WACC?Key Learning Outcomes

- Calculate WACC

- Cost of Equity

- Dividend Growth Model

- CAPM

- Cost of Debt

- Adjust for tax rate

- Capital weights

- Issues with WACC and solutions

- Pure play

- Subjective